Maternity Health Insurance

Maternity Health Insurance

Welcoming a new baby to the family is not only a matter of great joy but also of great responsibility. It is best to keep yourself adequately prepared both emotionally and financially beforehand to avoid any hassle during the phase of childbirth. It is now that you feel the need and importance of maternity health plans.

As the name suggests, maternity health plans are exclusively crafted to cater to the unique financial requirements of the maternity phase of pregnancy, childbirth, and neonatal care.

What is the need for Maternity Insurance?

Beginning parenthood is one of the most significant milestones in life. This requires extreme care and protection, in every aspect including mental, physical, and financial. However, this journey might prove to be tough if you are not appropriately prepared to efficiently manage medical inflation.

A maternity health insurance plan offers effective financial protection throughout the pregnancy course, pre- and post-hospitalisation costs, pre-and post-natal care and treatment expenses as required, delivery expenses, irrespective of the type of delivery, ambulance charges, etc.

Therefore, to ensure complete financial protection during this exciting as well as tense phase, it is best to purchase a befitting maternity health insurance plan.

Reasons to opt for Maternity Insurance along with Indemnity Health Insurance plans

Indemnity health plans are those special plans in which you get reimbursed by your chosen insurer after the course of the hospitalisation is over. Depending on the terms and conditions of the insurance plan concerned, you are eligible to claim up to the optimum sum insured amount. You can purchase this sort of policy as an individual plan or as a part of a family floater policy.

Investing in health insurance at a young age is one of the best things that you can do for your family. Your familial responsibilities remain low at that time, so paying a health insurance premium does not seem to be quite burdensome.

However, you must note that not all indemnity health plans offer maternity coverage benefits. If you would like to ensure complete protection for your entire family, it is best to include maternity coverage benefits in your health plan. Depending on your current financial status and familial requirements, you can even opt for adding maternity coverage as a rider to your existing health policy.

This will ease the financial tensions during the tense and exciting phase of adopting parenthood by covering all the medical care and treatment costs incurred throughout the course.

You must note that standalone maternity health insurance plans are still unavailable in India. Most of the maternity coverages available now are a special add-on rider in existing indemnity policies. However, due to increasing demand and popularity, a handful of plans like Care Joy Plan have emerged that focus well on maternity requirements.

Why buy Maternity Insurance Plans?

Some of the principal reasons to purchase and maintain Maternity Insurance are:

1. Medical back-up:

Maternity policies cover delivery expenses, be it normal or Caesarean. Therefore, you need not worry about the financial resources regarding the pattern of delivery adopted as per requirement.

Apart from this, certain plans even cover pre- and post-hospitalisation expenses for 30 and 60 days respectively. Other medical charges like the surgeon’s cost, room rent, consultation fees, medical investigations, medicines, etc. are also covered.

2. Delivery in any private hospital:

Due to the rising demand for quality healthcare, the preference for private hospitals is gaining rapid popularity. The standard cost of normal delivery in a private hospital revolves approximately INR 50000 and INR 70000, while for a C-Section, it may reach INR 1 lakh.

Moreover, pregnancies are highly unpredictable and may often lead to unprecedented complications, raising the bills significantly. A Maternity health cover may largely ease the process, ensuring efficient financial backing.

3. Neo-natal coverage from day 1:

A tiny new life requires extreme medical support and care. But most standard health policies begin their coverage span for children till they are 90/91 days old. However, a maternity health cover offers this benefit from the very first day. Some of these plans also include vaccination costs from the beginning till the policy term.

4. Prepare for complications:

Any special pregnancy situation might require premature delivery, where the newborn needs incubator support. Such requirements might raise the daily hospital cost to up to INR 10000. The already stressful situation might become tenser because of the mounting hospital bills. To keep yourself prepared, you can opt for maternity plans that cover neo-natal critical ailments or suffer from any congenital health issue.

5. No financial burden for family planning:

Most couples these days take time to start a family. Keeping this in mind, the insurance providers offer maternity plans with sub-limits ranging between 1 and 4 years, depending on the type of plan you have chosen. This keeps your financial burden on the lower side during family planning.

Types of maternity plans available in India

Considering the current scenario, the importance and popularity of maternity health coverage are on the rise. But, in the Indian insurance market, maternity health insurance policy is still unavailable as a standalone plan. It is mostly available as a rider to an existing indemnity health coverage.

Depending on the terms and conditions of the health plan you have chosen, there might exist varying waiting periods to avail of the maternity coverage benefits. It differs from insurer to insurer and policy to policy. It is best to opt for coverage that offers a minimal waiting period.

A thorough research of the types of plans available in the market will reveal the true picture.

There exist differences in the coverage span of the plan too. Some plans offer critical illness care during maternity. Depending on the circumstances, it is advisable to go for the one that offers optimum coverage and protection.

Several insurers offer maternity coverage benefits as an inclusive part of the basic family floater policy or an individual indemnity plan. If you are not prepared beforehand, you can always buy a separate maternity coverage, which will amount to slightly more expensive than buying it as an add-on. But, you must carefully research before doing so, as not many Indian insurance companies offer it.

However, you must note that maternity coverage benefits remain limited under the scope of the particular plan that you have chosen. You can make the maximum claim up to the amount of the sum insured depending on your premium payout amount that you have decided while purchasing or renewing the plan.

In this context, you must note that most Indian insurance providers offer maternity coverage for up to two childbirths.

Many Indian insurance providers offer maternity coverage as a separate add-on feature along with the basic health insurance policy. This is a comparatively easier and more reasonable way to enjoy maternity coverage benefits.

This maternity add-on feature also offers financial coverage for the vaccination of the baby along with other medical treatment and care costs that may emerge during the course.

Under standard circumstances, you can enjoy pre- and post-hospitalisation costs of 30 days and 60 days respectively.

Key features of maternity insurance plans

Maternity health insurance comes with a host of exclusive unique features that need special highlighting:

1. Comprehensive coverage:

Most maternity health insurance coverage plans offer comprehensive benefits up to the limit of the entire amount sum insured for all expenses related to maternity including delivery costs, hospitalisation expenses, neonatal care, etc.

2. Waiting period:

The maternity health plans are designed such that you have to maintain a standard waiting period ranging between 9 months and 3 years, depending on the terms of the plan concerned. Because of this clause, it is better to opt for maternity coverage beforehand, so that the waiting period is over during the time of need.

3. Cashless delivery option:

You can easily enjoy a cashless delivery facility at any of your preferred network hospitals with maternity insurance coverage. As per the terms of the chosen plan, the bills get settled automatically by the insurer with the hospital authorities. You need not have to worry about finances in this respect.

4. Fast claim settlement:

The insurers tend to settle maternity claims comparatively faster. This ensures the best medical care facility and hassle-free procedures.

5. No Claim Bonus:

You can even receive a special No Claim Bonus as a yearly increment in the amount of the sum assured for each claim-free year.

Benefits of maternity health insurance plans

From the above discussion, it is clear that maternity health insurance comes with a host of handy benefits. Some of the most significant advantages of maintaining a maternity cover plan are:

1. Delivery and labour coverage:

One of the most significant aspects of maternity coverage is that it acts as a protective shield for all delivery-related expenses be it normal or C-section, which can prove to be financially pretty burdensome under normal circumstances. Apart from that it even covers medicine costs, room rent, surgeon’s fees, consultation charges, and other related expenses.

2. Neonatal care:

Maternity insurance also covers all the costs needed for newborn care. At times, due to premature delivery, the newborn needs incubator support which is quite expensive. If you possess maternity coverage, it will all be covered under the scope of the plan.

3. International maternity coverage:

comprehensive maternity plan offers international maternity coverage benefits. This implies that even if your delivery happens outside the geographical boundaries of the country, all the associated costs will be covered.

4. Pre- and Post-hospitalisation neonatal care:

All the expenses incurred before the hospitalisation of the expecting mother and post-hospitalisation costs of both the mother and the child get covered under the scope of maternity coverage up to a stipulated time as per the terms of the plan chosen. You are allowed daily hospital allowance, along with room rent and ICU costs, if required.

5. Ambulance coverage:

Certain maternity plans even offer ambulance costs incurred related to maternity emergencies. The amount of this coverage is decided as a percentage of the total amount of sum insured or as a fixed amount, considering the terms of the plan.

6. Domiciliary hospitalisation:

Depending on the circumstances, f you are home-hospitalised for maternity contingencies, then all the costs incurred in the process, get covered under the plan.

7. Organ donation coverage:

Organ donation charges are also covered within the scope of maternity insurance.

8. Complimentary health check-ups:

Pregnancy requires frequent and regular health check-ups and close monitoring. Maternity coverage offers complimentary health check-up benefits.

9. Premium discount:

You can enjoy special discounts or rewards on premiums paid towards maternity coverage health plans.

10. Tax benefits:

As per the provisions of Section 80D of the IT Act, you can claim an optimum tax deduction of up to INR 75000 on premiums paid towards health insurance.

What is included/not included in maternity insurance plans?

Common inclusions

- Some of the basic inclusions of a standard maternity health insurance plan are:

- Ambulance charges

- Treatment costs related to in-patient care

- Medicine costs

- Costs incurred due to follow-up visits

- Expenses for prenatal care

- Daycare treatment costs

- Vaccination charges for the baby up to 1 year

- Room rent expenses

- Neonatal protection cover

- Delivery cost, both normal and C-Section

Common exclusions

- Any expenses incurred due to cosmetic surgery

- Any pre-existing ailment

- Any pregnancy-related expenses before the completion of the policy waiting period

- Any medical expenses incurred for treating eyesight, dental, and hearing issues

- Costs for vitamins and supplements

- Any medical costs incurred during the gestation period

- Infertility treatment costs

- IVF costs

- Ectopic pregnancy

- Miscarriage treatment costs

- Pregnancy of women above 45 years

- Costs incurred for treating any congenital issue

When to opt for maternity health insurance plans?

Most maternity plans that are currently available in India, come with a waiting period roughly between 9 months and 4 years. Moreover, insurers may deny coverage benefits if you are already pregnant. Moreover there even exists an age capping clause for availing of maternity coverage.

Like any other standard health insurance plan, you will have to pay a comparatively lesser premium amount for early purchase of maternity coverage. You can add a maternity coverage add-on after your marriage or during plan renewal.

Considering all these factors, it is better to purchase maternity cover, well before you begin planning for family expansion.

How much coverage is needed in maternity insurance plans?

Pregnancy is a highly vulnerable state of health, which may lead to unprecedented health complications at any point. This implies additional medical treatment and care, thus raising the already mounting hospital costs. Therefore, it is best to opt for a maternity plan that offers optimum coverage protection.

However, you must note that most of the Indian insurance providers offer limited maternity coverage, approximately ranging between INR 15000 and INR 50000. However, some insurers extend this limit up to INR 1 lakh.

Considering all the factors involved, you must make your choice regarding the coverage limit and then proceed accordingly. It is better to maintain a higher margin to handle any surprising contingencies.

Factors that affect the premium of maternity insurance plans

Considering the general trend, the premium value of maternity health cover is comparatively expensive, because of high-risk involvement, leading to an entire 100% claim ratio. Some of the significant factors that affect the premium value of a maternity health plan include:

- The age of the concerned lady plays a significant role in this context. The age of the person is directly proportional to the premium value, implying the lesser the age, the lower the premium. The risk involved in a higher-age pregnancy is much greater as the associated risks increase, thus increasing the premium value.

- Any health risk associated with a comparatively healthy woman is much less than that of a person suffering from multiple health issues.

- In the case of group health plans, the total number of employees, their designation, location, and profile of the concerned company all are important determining factors in deciding the premium value.

Waiting period for maternity insurance plans

Most maternity health plans come with a waiting period, ranging approximately between 9 months and 4 years. You cannot raise any maternity-related claim during this waiting period. The span of this waiting period varies from one insurer to another. You must seek a plan that offers a comparatively low waiting period, considering all the other factors are favourable.

Therefore, it is best to purchase the cover well beforehand right after your marriage, and then proceed accordingly. This will make you avail of the coverage benefits during need.

A step-by-step guide to buying maternity health insurance plans

Online :

- Visit the official website of your chosen insurer and move to the health insurance page

- Enter the name of the beneficiary

- Proceed to get the plan and click on the tab

- Enter all the relevant details, revealing the most suitable plan list

- Choose the preferred plan

- Move to the next page to select the amount of sum insured and view the exact premium amount

- Click the “Buy now” tab to purchase the desired plan

- Pay the premium online and the plan is yours

- You can download your policy document online

Offline :

- Locate the nearest branch of your chosen insurer

- Visit them and inform them regarding your plan to buy a maternity cover

- The representative(s) will guide you accordingly to choose the most suitable plan

- Once you have made your final choice, duly complete the application procedure and submit all the relevant documents

- Submit them all along with the premium payable amount

Documents needed to buy maternity insurance plans

Important documents that you need to submit to your insurer for purchasing maternity health insurance include:

1. Age proof: Birth Certificate; Aadhaar Card; passport, Passing certificate of 10th or 12th

2. Identity Proof: Aadhaar card; Driving License; passport

3. Address proof: Ration card; Driving license; electricity bill

4. All the relevant health check-up reports for policyholders above 45 years

5. Recent passport-size photograph.

Who can opt for maternity insurance plans?

Maternity insurance is ideal for:

- Newly married couples

- Couples willing to expand their family

- Couples willing for a second kid

- Couples who wish to have kids in the future.

How to claim maternity insurance plans?

A. Cashless claim:

You can utilise the cashless claim settlement facility at any of the network hospitals of your chosen insurance provider.

You need to duly fill in and sign the maternity insurance claim application form available at the TPA desk of the hospital.

Submit all the necessary documents along with the application form.

The concerned hospital must request clearance before claim settlement.

As soon as the application is granted by the insurer, all the bills are immediately settled directly with the hospital authorities.

B Reimbursement claim:

Due to an unprecedented situation, if you have to seek maternity treatment at any non-network hospital, you can file for a reimbursement claim settlement.

Immediately notify your insurance provider about the incident.

After discharge, complete the claim application form and submit it along with all the relevant documents.

The application will be reviewed and further documentation will be asked for if required.

Once everything is duly reviewed and approved by the insurance-providing authorities, your claim is settled by reimbursing the necessary coverage amount to your registered bank account.

List of top 10 maternity insurance plans available in India

| PLAN | COMPANY | VARIANT | COVERAGE | SUM INSURED LIMIT |

| Aditya Birla Activ Health Platinum Enhanced Plan with maternity cover | Aditya Birla Health Insurance | – | All the baby birth expenses, post-birth treatment costs, immunisations, pregnancy complication treatment costs, cost of abortion due to pregnancy complication, etc. | INR 2 lakhs to INR 2 crores |

| Bajaj AAllianzHealth Guard Family Floater Health Plan with MI cover | Bajaj Allianz Health Insurance | — | All maternity-related expenses including the medicine and treatment costs of the newborn | INR 3 lakhs to INR 50 lakhs |

| Barati AXA Smart Super Health Insurance with MI cover | Barati AXA Health Insurance |

|

| INR 20 lakhs to INR 30 lakhs in the case of Uber plan |

| Care Health Joy Health Insurance Plan with maternity cover | Care Health Insurance Company |

| All maternity-related expenses and immunisation and treatment costs of the newborn | |

| Chola MS Family Healthline Insurance Plan with maternity cover | Cholamandalam MS Health Insurance |

|

| |

| Digit Health Insurance with Maternity cover | Go Digit Health Insurance | — | Delivery costs, neonatal coverage, infertility coverage, coverage for abortion, etc. Offers 200% of the sum insured during the second childbirth | — |

| Edelweiss Health Insurance Plan with Maternity cover | Edelweiss Health Insurance |

|

| — |

| Future Generali Health Total Mediclaim Insurance with maternity cover | Future Generali Health Insurance |

| — |

|

| Kotak Mahindra Premier Plan with Maternity cover | Kotak Mahindra Health Insurance | — | Offers coverage for missed abortion and delivery expenses of up to the first 2 children of the insured individual, born within the policy tenure; pre- and post-natal expenses, immunisation costs of the children till 2 years | — |

| Niva Bupa Heartbeat Family Floater with Maternity cover | Niva Bupa Health Insurance |

| Offers several types of maternity benefits depending on the plan variant for the first 2 children, provided the insured couple maintains the plan for 2 consecutive years | — |

Things you must know before buying a maternity insurance policy

Some important factors you need to consider before purchasing maternity health insurance cover are:

1. Sub-limit:

Similar to any normal health plan, maternity policies also offer a sub-limit clause. You must be wise enough to research well before making your final decision.

2. Premium amount:

Depending on the plan variant, the coverage span, and the total sum insured amount, the premium value is decided. You can take the help of the premium calculator to know the exact premium amount payable for the concerned plan.

3. Plan coverage:

The insurance covers you buy, must offer comprehensive coverage for all the expenses related to pregnancy and childbirth, including hospitalisation costs, consultation fees, costs of health check-ups, medications, etc.

4. Waiting period:

Most Maternity covers have waiting periods which may vary between 9 months and 6 years. Depending on your planning, and financial and familial situations, you should make your choice.

5. Network hospitals:

To avail of cashless hospitalisation facilities, you must be aware of the list of network hospitals covered by your chosen insurer. The bigger this list is the better.

6. Available discounts:

Since most maternity covers are add-ons, it is best to seek available discounts to reduce your effective premium payout amount.

7. Number of children covered:

Most insurers cover up to the first two children. However, you must be aware of the exact details of your chosen plan before proceeding.

8. Abortion and termination:

Some maternity plans offer abortion and stop costs of up to two pregnancies, provided it is undertaken due to physical complications.

Frequently Asked Questions

Except for group health plans, no insurer offers maternity coverage for already pregnant women, since it is treated as a PED.

Yes. Depending on the terms and conditions of the chosen plan, it may include maternity cover.

If the child of the insured individual is born with any ailment or deformity, it may or may not partially be covered by the insurer, depending on the terms of the plan.

Yes, it can cover your second pregnancy, provided you have completed the waiting period.

The entry age of the insured individual must be at least 18 years, while the exit age differs from insurer to insurer. However, it is mostly set at 45 years. The geographical boundaries are also considered under certain conditions.

Leading Health Insurance Companies

Latest Blogs

Introduction As we age, we start taking our health more seriously. But with rising medical costs, we can’t rely only on savings or family support. Health insurance is important for adults and super essential for senior citizens. The right policy covers you in medical emergencies without draining retirement funds. Choosing from so many health insurance plans available in the market can be so overwhelming. The best health insurance policy for seniors will always be the one that lets them access quality healthcare without financial worries. Choosing insurance for senior citizens is not the same as for younger people because their health needs and risks are very different. Here we will discuss what to look for, how to compare the various options and how to choose the right cover. Why Senior Citizens Need Special Health Insurance Regular health insurance plans are often not suitable for older adults. The reason is simple. With increasing age, there’s a rise in medical needs, doctor visits and chances of hospitalizations. Most definitely, the policies designed for younger people don’t offer the coverage that seniors really need. Here are the reasons that make senior citizen health insurance so crucial: Higher medical risks– Older adults are obviously more prone to illnesses. Heart disease, diabetes or joint problems are common. Rising treatment costs– With every passing year, the cost of hospital stays, surgeries and medicines is going up. Limited income after retirement– Most seniors depend on their pensions or savings. This may just not be enough to cover sudden expenses. Peace of mind– Having a health insurance means the financial load is off from your pocket and emergencies can be handled. Features of a Good Senior Citizen Health Insurance When you’re looking for the best health insurance policy for seniors, take a little time to decide but don’t jump on the first policy you see. After all, you must carefully compare the options and look for these key features: Higher Sum Insured You can never expect the medical bills and so, the higher the sum insured, the better. It’s generally recommended to go with plans that offer at least ₹5–10 lakhs cover for insurance for senior citizens. Pre-Existing Disease Cover Most seniors already have certain health conditions like diabetes, high BP, or arthritis when they are looking for a plan. A good policy should start covering these after a short waiting period. Shorter Waiting Periods Some policies actually make you wait for about 3–4 years before covering pre-existing conditions. Always look for policies that start providing cover in 1–2 years. Cashless Hospitalization An insurer with a wide network of hospitals will make hospital stays easy. You will get cashless treatment and don’t have to worry about arranging money on the spot. Daycare Procedures With science being so progressed, modern treatments don’t require long hospital stays. Hence, daycare procedures should be a part of the best health insurance policy for seniors. Ambulance & Home Care Cover Getting extra benefits like coverage for ambulance charges and home treatment can be such a huge help during emergencies. Affordable Premiums with Value Honestly, plans with the lowest premiums are not always the best. Try to balance the cost with the benefits and coverage you get and the insurer’s claim settlement record. Factors to Consider Before Buying Health Insurance for Seniors Reading brochures is not enough while choosing the right health insurance plans. You also need to consider some points while making a purchase: Age Limit of the Plan Some policies only accept people up to 65 years of age. If you’re older, look for senior citizen health insurance that caters to even above 70 or 75 years. Co-Payment Clause In many policies, seniors are asked for co-payment (sharing a part of the bill). For example, if co-payment is 20% and the bill is ₹1,00,000, then the individual will pay ₹20,000. Hence, look for a lower co-payment. Renewal Age The policy should offer lifetime renewability, which means that the cover should continue smoothly even at a very old age. Coverage for Critical Illnesses Many old people fight with heart conditions, kidney failure and even cancer. The best health insurance policy for seniors is the one that covers critical illness. Claim Settlement Ratio The claim settlement record of the insurer tells a lot about its reliability. A higher ratio means there will always be better chances of your claim getting approved quickly. How to Compare Senior Citizen Health Insurance Plans When comparing senior citizen health insurance, we mostly focused on premiums and coverage but actually, we must look at a few more things. Here’s a checklist you must refer to: The premium vs the benefits you get Waiting periods for covering existing illness Hospital network size Percentage of co-payment Extra benefits (like ambulance, home care and alternative treatments) You can make a simple comparison table with a few policies so you can know which one gives the most value. Common Mistakes to Avoid While Buying Insurance for Seniors Going only for the cheapest plan– The biggest mistake! Remember that low premiums may also mean there are chances of high co-payment % or exclusions. Not checking exclusions– Common illnesses like cataracts or knee replacements for seniors are also excluded by some plans. Ignoring the waiting period– If the senior person is already having a condition, a waiting period of around 4 years might be too long. Skipping lifetime renewability– Some policies stop their benefits at a certain age and so, seniors are left uninsured later. Not reviewing the hospital network– the nearest hospital should also be covered, else you won’t get cashless treatment. Tips for Getting the Best Health Insurance Policy for Seniors Start early– Naturally, the earlier you buy a plan, the lower the premiums you have to pay. Waiting till 70+ is not a good idea. Choose family floater carefully– If your parents are very old, it’s better to take an individual insurance for senior citizens instead of a floater. Read the fine print– Before signing, go through all the

...Introduction Damage to property can be a huge loss. We need reliable property insurance to protect our home, workplace or any other valuable property against uncertainties. It’s certainly a must-have. But there are just so many different property insurance plans out there. Each insurance company makes the same promise. They claim to offer affordable premiums, extensive coverage and quick & easy claim settlements. With so many options, how do you know which one is actually the one for you? Comparing property insurance quotes is very important; it’s just like comparing prices before buying a gadget or maybe a bike. Only by analysing multiple insurance quotes can you find the perfect option that offers value for money. Why Property Insurance Matters Buying a property, whether a home or a place of work, means making one of the biggest investments. Any kind of damage to it due to fire, theft, accident or even a natural disaster leads to a huge financial loss that can only be covered with a property insurance policy. The right property insurance plans in place will: Protect your property from damaging natural disasters. Cover losses that may happen due to fire or explosions on the premises. Get protection for the loss in case of robbery. Stay protected in case of accidental damage. Continue with the business if it was a commercial property. Getting a property insurance plan gives you assurance that you won’t have to face the entire financial burden alone in case of an unexpected mishap. What Are Property Insurance Quotes? When you reach out to an insurance company to buy a policy, they give you a cost estimate for the kind of coverage you’re seeking. This is called a property insurance quote and it includes various information like: The premium: How much you will have to pay and the frequency (monthly, quarterly or annually). The coverage details: What all risks are covered and the maximum amount that’ll be received. The deductibles: How much would you have to pay from your pocket before the insurance comes into the picture. All the detailed terms and conditions of the insurance policy. Upon comparing property insurance quotes, you not only see the difference in the prices but also what you will actually pay for. Why It’s Important to Compare Property Insurance Quotes? Would you ever buy the car you see in the showroom without checking a few more? You won’t! And the same behaviour should be for insurance. Here’s why you must compare: Save Money– Different companies offer similar coverage but premiums may differ. When you compare, you can get the most cost-effective deal. Understand Coverage– Not all property insurance plans available will cover the same set of risks. For example, some companies just don’t include natural disasters. Avoid Surprises– Reading the details carefully helps you know what’s included and what’s not and hence, no shocks later during claims. Tailor to Needs– By comparing, you choose the correct plan for your property type, whether it’s residential, commercial, rental, etc. Best Ways to Compare Property Insurance Quotes Now comes the main part! How exactly should you compare quotes so that you end up making a smart decision? Look Beyond the Premium While it’s normal to check the price as the first thing, it’s not a good idea to get swayed by the cheapest property insurance quotes. A low premium often means either that the coverage is limited or the deductibles are high. Let’s say you might find one policy at ₹7,000 per year and the other one at ₹11,500. The catch is that the cheaper one doesn’t cover natural disasters, while the expensive one does. Hence, you get better value in the second one. Check the Coverage in Detail Not all property insurance plans will protect you against the same set of risks. The coverage should match your property type and location risks. So, make sure that all this is included: Damage due to fire and accident Natural calamities cover Theft or burglary Electrical or mechanical breakdown Third-party liability (you causing damage to another person’s property) Understand Deductibles Basically, a deductible is the amount you agree to pay before insurance kicks in and lower premiums usually have higher deductibles. When comparing property insurance quotes, don’t miss out on this point. Say your policy has a ₹40,000 deductible. So if your damage is ₹65,000 then the insurance will only cover ₹25,000. Compare Claim Settlement Ratios Getting a property insurance plan is only useful if the company doesn’t make a fuss while settling claims. You must check the claim settlement ratio of the insurer and learn how many claims they actually take action on. Even if the premium is slightly higher, go for a trusted insurer because a cheap plan might delay payments. Look for Add-Ons and Benefits Some insurers offer extra features. Adding them may slightly increase your premium but then the protection also becomes wider. You can consider: Rent loss cover: If you live in a rented house and it becomes unlivable after damage, the policy will help. Coverage for valuable contents inside the property: It provides coverage for jewelry, expensive appliances, etc. Temporary accommodation expenses: In case you can’t stay in your home after damage, that will be taken care of. Compare Policy Terms and Exclusions Always read the fine print because you might assume some coverage when it might not be there. Like some plans don’t include damages caused by negligence or damages from gradual wear and tear. And when you carefully compare property insurance quotes, you’ll know exactly what you’re getting. Check Flexibility of Payment Plans Some insurers allow you to pay premiums at your preferred duration. Monthly, quarterly or annually; you choose. You can always pick what fits your budget and which option helps you save more over time. Monthly vs Annual Premiums – Which is Better? When you have a bunch of property insurance quotes with you, you’ll notice that there is also an option of paying monthly or annual premiums. Here’s the difference:

...Introduction Ever seen a hospital bill after a surgery or a few weeks of stay? It’s in lakhs! With our parents or grandparents growing older and who may already have health conditions, managing healthcare expenses is one huge worry. One emergency can take away years of savings and this makes having the best senior citizen health insurance a must. But with all insurers claiming to provide the ideal health insurance plans, making a decision becomes very tricky. A policy that looks affordable may not offer important coverage and the other provides good coverage but has high premiums or hidden clauses. So, how do we land the best health insurance policy for seniors? We’ll find out! Why Senior Citizens Need Special Health Insurance Health risks naturally increase with age. Growing older, especially in the 60s, it’s common to get affected with lifestyle diseases, chronic conditions and of course, age-related health issues. Senior citizens often need more to visit doctors more frequently and then there are medicines, or even hospital care. Families that don’t have insurance for senior citizens often have to pay out of their own pocket and this is a huge financial burden. However, a dedicated senior citizen health insurance plan will make sure that you get: Coverage for pre-existing diseases like diabetes, high BP etc Cashless treatment in a hospital near you that falls under the tie-ups Security of medical needs and peace of mind for the whole family. Many people feel that senior citizen health insurance is a way to give back to their parents. It’s a security that ensures they don’t have to worry about funds when they need care. Key Features of the Best Senior Citizen Health Insurance There are several policies available and each one is different in some or the other way. But what truly makes a policy the best senior citizen health insurance are these features: Comprehensive Coverage The reliable plan offers wide coverage. It includes hospitalization and surgeries, day-care procedures and critical illnesses and doesn’t leave policyholders disappointed during treatments. Pre-Existing Disease Coverage It’s common for seniors to be living with certain health conditions. The best health insurance policy for seniors doesn’t come with long waiting periods and the coverage starts as early as possible. High Sum Insured Options Medical treatments come with huge bills. A policy that offers a higher sum insured, like ₹5–20 lakhs or more, will always provide better protection when needed. Cashless Hospital Network When the policies have tie-ups with a large number of hospitals, admission and treatment become stress-free. Treatment begins without delay and there is no need to arrange money during emergencies. Low Co-Pay or No Co-Pay Under some health insurance plans, the insured has to co-pay a part of the hospital bill. A plan with lower or no co-pay is a lot more beneficial for seniors. Affordable Premiums With your age, premiums also increase. A good policy is one that balances cost with benefits so that coverage continues without being unaffordable. Things to Consider When Buying Insurance for Senior Citizens While you must look at the benefits when choosing insurance for senior citizens, you must also understand what could go wrong. Here’s what you must definitely check: Room Rent Limits: Some policies cap the room rent and exceeding it means paying extra costs. Disease-Specific Limits: There may also be coverage limits for certain health conditions. Go through the details properly to avoid any confusion later. Waiting Periods: The waiting period of some plans makes seniors wait for a few years before the coverage starts for pre-existing diseases. Hence, the shorter, the better. Exclusions: Every policy has some exclusions. Like they might not cover for cosmetic surgeries or maybe self-inflicted injuries and other things. So, know what’s covered. Group vs Individual Plans for Seniors There are times when senior citizens may be covered under a family health insurance or corporate group plan. Of course, that’s helpful but you can’t rely only on these. Family Health Insurance: It might not offer enough sum insured in case multiple members of the family need it at the same time. Corporate Group Insurance: The policy ends when the employee retires or switches job. Buying a dedicated senior citizen health insurance policy is always a safer choice because then you get lifelong protection. Comparing Policies to Pick the Best Below are the super-important factors that should be kept in mind while you’re comparing the best health insurance plans: Coverage vs. Premium: Merely being the cheapest is not enough. It should cover major needs like pre-existing conditions, hospitalization and critical diseases. Claim Settlement Ratio: Pick a company with a good claim record because it ensures smooth approvals. Customer Service: We all expect quick and helpful support during emergencies. Renewability: The best health insurance policy for seniors can be renewed without any age restrictions. Let’s take an example of Mr. Gupta (65 YO) and Mrs. Gupta (62 YO), who need health insurance and they have two options: Plan A: While it has a low premium but hospitalization is covered only after a 4-year waiting period for pre-existing diseases. Plan B: Charges a higher premium but you need to wait just 1 year for hospitalization, critical illnesses, day-care treatments and treatment of pre-existing disease. So, which is the best senior citizen health insurance for them? Plan B! Because Plan A seems affordable but won’t help if a hospital stay is required in the next 1-2 years for some pre-existing conditions. Hidden Clauses to Watch Out For Before you sign the agreement, take some time and read the brochure carefully because there may be some common traps that can turn into ugly surprises: The waiting periods for pre-existing diseases can sometimes be as long as 4 years. There may be disease-specific sub-limits as well like cataract cover could be limited to ₹23,000 per eye or ₹47,000 for joint replacement. Dental, cosmetic or self-inflicted injuries are often not included in the plan. Surprisingly, some insurers also increase the premium amount after

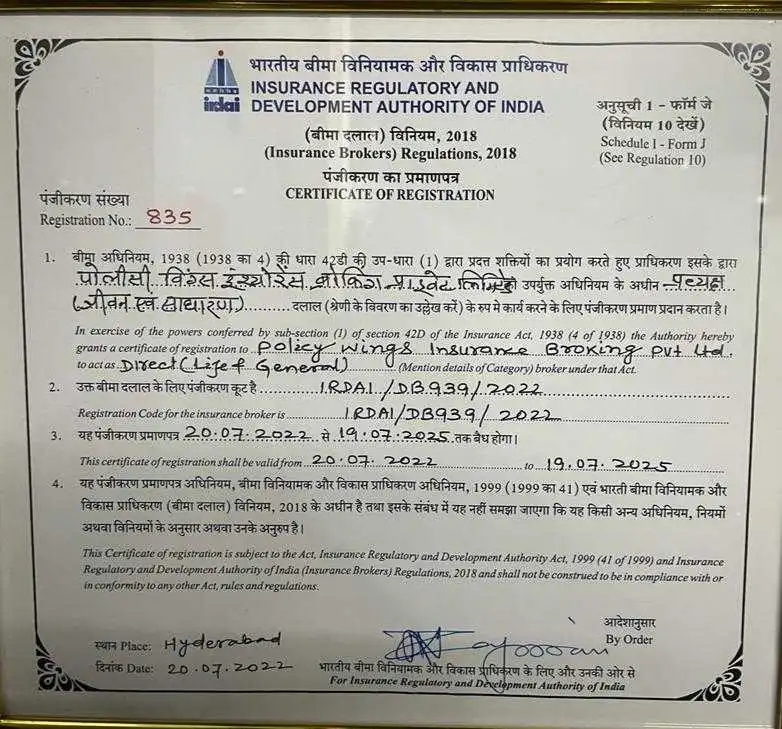

...Introduction The year 2025 saw the Indian insurance policyholders being more aware about their rights than ever before. However, they still find the claims processes difficult to go through. The consumers are frequently feeling disgruntled because of complicated paperwork, waiting for long periods and having disagreements with their coverage, to name a few. In India claims advocacy has evolved as an essential support system with brokers making sure fair treatment and timely settlements for policyholders. The function of brokers has shifted from merely policy placement to a more supervisory role in the safeguarding of policyholder’s rights during claims, which is the most difficult phase of the insurance journey. The Role of Brokers in Claims Advocacy Insurance brokers are the middlemen between the people who own the policies and the companies that provide the policies. In the claims setting, their work is not only on the side of the administration. Brokers assist to do the following tasks: they interpret policy terms, they execute the required paperwork, they negotiate with the insurance companies and they even provide legal assistance if there is a conflict. By advocating for policyholders brokers make sure that the insurers honor the coverage promised in contracts with reducing the risk of delays or unfair rejections. By combining the technical aspects of the insurance industry with the role of advocator, brokers have become an important factor for the trust in the system. Challenges in Claims Settlement Despite regulatory reforms, claim settlement remains an area of friction in India. The common issues that frequently occur are: Ambiguity in Policy Terms: Disputes are usually the result of vague exclusions or unclear definitions of the terms. Delays in Processing: Inadequate documentation and procedural inefficiencies are the main reasons that settlements can be delayed. Claim Denials: Insurers may refuse claims because the policyholder did not disclose all the facts, informed the insurer late or on technical grounds. Under settlement: When claims are only partially paid leaving losses uncovered then the total amount of loss causes dissatisfaction and filing of lawsuits. These issues have led to a number of court decisions which have emphasized that insurer’s contracts should be interpreted in a manner that is fair and favorable to the insured, especially when the language is unclear. Legal and Regulatory Framework In the Indian insurance industry, the Insurance Regulatory and Development Authority of India (IRDAI) is the monitoring body that keeps the insurance companies within certain time limits for their claim settlement and requires them to indicate the reasons explicitly in case of a denial. As licensed intermediaries, brokers have the duty to work in the interest of their clients and to ensure that these requirements are fully complied with. The courts through the Consumer Protection Act have in their judgments always placed the liability on the insurer in such cases where the claim has been rejected in an arbitrary way and without any justification. There are numerous instances where the courts have not only ordered the complete settlement of the claim but also have awarded the complainant money for the inflicted mental agony and the litigation costs. The active participation of brokers diminishes to the lowest amount the possibility of conflicts that become legal by providing the on time execution, accurate documentation and fair negotiation. Moreover, affected by the introduction of the Digital Personal Data Protection Act, 2023, intermediaries dealing with sensitive claim data must maintain confidentiality on a high level. Violations or data breaches in the claims management process may not only lead to the issuing of fines but also to damage the organization’s reputation. Benefits of Insurance Claims Advocacy Fair Settlements: Brokers represent the rights of the insured and ensure that the claims are not rejections which are false or under settlements. Expert Guidance: Brokers assist clients in understanding policy wording thus they can communicate better and the claim application becomes stronger. Reduced Legal Risk: With professional support, policyholders are less likely to face prolonged litigation. Faster Resolutions: Coordinated communication between brokers and insurers minimises delays in claim settlement. Consumer Protection: Brokers’ accountability under law ensures policyholders have an additional layer of support against insurer misconduct. Brokers as Risk Managers Beyond claims handling, brokers also assist businesses and individuals in adopting preventive measures to minimise claim disputes. The list can even go to helping a client disclose the true facts of the situation, maintaining the risk management system that helps the company and keeping detailed records. Being proactive will give you the benefits of a smooth claim and that you will comply with the requirements of the policy. Claims advocacy is also a good thing for negotiations with big settlements covering property, liabilities or health where conflict can reach millions of dollars as these are corporate clients. The knowledge of a broker through the documentation process and abiding by the regulatory requirements is what makes the difference between winning and losing cases. Upcoming of Claims Advocacy in India As the insurance part enfolds digitisation and the part of brokers in claims advocacy is also developing: AI Driven Claims Help: Data tools support brokers identify lost documents and flag discrepancies early which reduces rejections. Digital Ledger Records: Established digital records of claims build up transparency and accountability. Fusion Models: While digital structure gets better efficiency, brokers can personally guide and it remains important in complicated cases. Insurance claims advocates in India are going to be in greater demand as the urban risks keep on increasing, climate related claims and regulatory scrutiny. Brokers will keep playing the role of interpreters between the insurers who are bound by contracts and policyholders who have been expecting a fair settlement. They will thus make a key contribution to the achievement of such settlements. Conclusion In the constantly changing environment of 2025 it has become crucial that the broker claims support be present for the proper and fair settlement of claims. Insurance brokers take on the roles of champions, mediators and compliance monitors, thereby facilitating rightful payouts to the insured. Claims assistance in India is empowered

...Introduction Commercial Auto Insurance in India and Fleet Insurance are not just selective defences but they are also required by law and important parts of operational risk management for delivery and logistics companies. Every commercial vehicle is mandated by the Motor Vehicles Act of 1988 to have third party liability insurance at least. Businesses that have to manage a large number of vehicles must optimise or upgrade to cost and coverage with well structured fleet insurance adhering to legal requirements. Legal Regulatory Framework Motor Vehicles Act 1988 and Central Motor Vehicles Rules 1989: Every vehicle in usage should have third party liability insurance in accordance with Section 147 of the Motor Vehicles Act. Financial penalties, vehicle seizure and operation suspension are the most possible outcomes of noncompliance. For commercial transport operators, additional operational and compliance guidelines are provided by the Central Motor Vehicles Rules. Insurance Act 1938 and IRDAI Oversight: Insurance contracts are governed by the 1938 Insurance Act as amended and policy standards, premium computations and claim settlement procedures are governed by the Insurance Regulatory and Development Authority of India (IRDAI). Driver Licensing Requirements: According to recent Supreme Court decisions such as Mukund Dewangan v. Oriental Insurance Co. Ltd. (2017) owners of Light Motor Vehicle (LMV) licenses are permitted to drive specific commercial vehicles weighing less than 7,500 kg gross vehicle weight. Driving without the proper licence or in violation of the terms of the licence may result in repudiation of the claim and possible legal repercussions. Types of Commercial Vehicle Insurance A. Individual Commercial Vehicle Insurance This policy which is intended for small operators or single vehicle owners can be set up as follows: Third Party Liability: required coverage for third partie’s property damage, injury or death. Comprehensive Coverage: includes benefits for personal accidents, fire, natural disasters, theft and own damage protection. Fleet Insurance a single master policy with uniform terms that applies to several vehicles. Third Party Fleet Insurance satisfies large scale legal requirements. Own damage, passenger liability, legal defence expenses and personal accident coverage are all included in comprehensive fleet insurance. Benefits include centralised claims processing, simplified renewals, bulk premium discounts and fleet operations specific add ons. Important Policy Elements and Factors The maximum amount that can be claimed for own damage coverage is known as the Insured Declared Value (IDV) and it is established at the time the policy is purchased. Premium factors are determined by the type of vehicle (heavy or light), operational geography, age, usage, safety features and claims history. Preferential rates are frequently secured through fleet agreements. Add-on Covers: Logistics fleets benefit greatly from coverage for employee compensation, passenger liability, towing assistance, legal defence and rental replacement. Claims Settlement and Network Access: To minimise operational downtime, assess insurer performance in terms of claim settlement ratios, turnaround times and network workshop availability. Enforcement, Disputes and Consumer Rights Regulatory Supervision: IRDAI publishes legally binding guidelines regarding grievance redressal procedures, premium structures and coverage requirements. Consumer Forum and Motor Accident Claims Tribunal (MACT) adjudication Case law shows that insurers need to provide verifiable proof to support claim repudiations. Consumer commissions have overturned arbitrary denials such as accusations of overloading without evidence. Notable instances consist of: After excessive claim settlement delays a fleet owner was awarded INR 11.16 lakh in compensation plus INR 50,000 for mental suffering. Defending claims in the face of overloading accusations made by insurers in the absence of supporting documentation. Instructing insurers to cover 75% of IDV in cases of auto theft that take place just before a policy expires. Coverage Affected by Judicial Interpretations Validity of Licence: Driving a commercial vehicle without the proper transport licence was deemed a violation of policy in National Insurance Co. Ltd. v. Kusum Rai (2006). Subsequent decisions like Sunita & Ors v. United India Insurance Co. Ltd. and Mukund Dewangan (2017) have clarified the scope for LMV licence holders operating commercial vehicles under particular weight limits. In United India Insurance Co. Ltd. v. Sathish Kumar (2019) the case of Third Party vs. Comprehensive Cover reaffirmed that Act only policies do not provide coverage for occupants or pillion riders unless an additional premium is paid. Burden of Proof in Overloading Allegations: In cases where insurers were unable to provide reliable proof of policy violations, state consumer commissions have rendered decisions in favour of policyholders. Strategic Best Practices for Logistics Operators Centralise Insurance Management: For cost savings and administrative effectiveness and implement a single fleet policy. Maintain documentation attesting to the validity and appropriate category of each driver’s license in order to ensure license compliance. Keep Thorough Records: To reduce disagreements during claims, keep track of vehicle loads, maintenance logs and trip records. Engage Reputable Insurers: Choose insurers according to their industry reputation, service network and settlement efficiency. Include Main Add Ons: Customise policies to include coverages that can handle your operational/funtional risks like legal defence expenses and driver personal accident insurance. Keep Up with the Law: Keep an eye on important court rulings, IRDAI circulars and modifications to the Motor Vehicles Act. Conclusion Commercial auto insurance and fleet insurance are imporatant tools for business continuity in the logistics and delivery industry as well as legal requirements given India’s strict regulatory framework. Financial exposure and operational risks can be considerably decreased by properly structuring insurance policies which should be based on statutory compliance, judicial precedents and operational realities. An integrated legally compliant insurance strategy is both a competitive advantage and a compliance requirement for companies with sizable fleets of vehicles.

...Introduction Term insurance India is witnessing an evolutionary change. A motion of innovation is reevaluating how individuals approach financial protection highlighting precision flexibility and fairness. This article explores the most recent innovations in term insurance in India which displays how new term plans 2025 are appropriate for modern needs and hold up by the recent trends and legal considerations. Term Insurance 2.0 India’s insurance environment is moving unquestionably toward Term Insurance 2.0 which is a drift away from traditional savings based life policies toward properly pure protection focused plans. These new perspectives are a highlight of transparency and cost effectiveness which can resonate with younger and middle class families and also seek maximum coverage with minimal complexity. Main features which define this shift are: Low prices for high coverage: Anyone can now protect life cover which can value multiple crores for a monthly outlay that is a fragment of past standard. Easy digital understanding: Online platforms permit quick comparisons, smooth purchases and less paperwork. Plain intent is on protection and not on returns: These plans remove complex investment structures and what you pay goes toward coverage. Custom Styled through Riders and Flexibility Trendy new term plans 2025 contain innovative customisation options that can speculate various life conditions: Add on riders: Policyholders can improve the basic term insurance with important illness cover, accidental death benefit or premium waiver in case of disability. Return of premium choices: Some of the plans now offer a return of premium feature if you survive through the policy term then you get back the premiums paid bridging the gap between protection and perceived returns. Adaptable payout structures: Families can also pick a lump sum payout or an income stream conditional on their financial planning needs. Prolonged coverage duration: Coverage now elongated up to age 99 which can ensure long term protection even in advanced age. All inclusive these new term plans 2025 delegate policyholders to customise protection to their life stage and responsibilities. Digital Innovation and Insurtech Strengthening Digital evolution has speeded up the expansion of term insurance India: Streamlined underwriting: Online platforms provide data driven assessment and quick issuance as well as decrease in friction of buying term insurance. Claim processing enhancements: Insurtech solutions are allowing smoother and faster claims which improves trust and customer experience. Personalised recommendation engines: Digital tools help individuals compare quotes and features which will be taking into account their risk profiles and coverage needs. Authoritative Pillar and Insurance Involvement Regulatory initiatives are forming term insurance India’s growth: Insurance for All vision: The insurance regulator’s long term plan highlights innovation grievance redressal mechanisms and comprehensive coverage understanding. Steady product portfolio: Even though traditional savings connect policies dominate the market there is increasing regulatory focus on promoting pure protection products. Digital sales with ethical shove: Authorities are uplifting digital adoption and strengthening regulation to restraint misselling and promote transparency. Adapting Trends and Recognising Challenges Despite these innovations awareness remains a hurdle: Less adoption rate: A recent survey disclosed only 34% of Indians have a solid term insurance plan. Misconceptions and limited awareness are said to be the major barriers. Switching NRI engagement: Non Resident Indians are progressively buying term insurance India products due to competitive/fierce premiums and rupee denominated advantage. Notable focus on working mothers: New age plans are now customised to assist working mothers through features such as maternity benefits, flexible premiums and women specific health riders. Legal Considerations, Liabilities and Case Contributions In the legal domain the term insurance India elevates important features around disclosure, duty and claim validity: Responsibility of disclosure: Insured individuals must disclose correct health and lifestyle information. Failure to do so can steer to claim rejection and raise issues of misrepresentation. Repercussion of non disclosure: Courts have held insurer rights to reject claims which emphasise the principle that a contract of utmost good faith (uberrimae fidei) supports term insurance India. Claims litigation: Recent judicial decisions underpins transparency and accountability insurers face legal obligations to swiftly investigate and decide on claims. Delay, obstruct or unfair denial may be deemed to be a breach of statutory and contractual duty. Regulatory recourse: Policyholders may appeal to insurance ombudsmen or courts in case of grievances. The regulator’s centre on fair redress mechanisms as part of its long range vision toughen legal recourse. Strategic Points for Policyholders As you calculate new term plans 2025 then you can consider these guiding principles: Understand your needs: Assess your family’s obligations, loans, dependents, education and match term insurance relatively-correct. Compare all the necessary features not just premiums: Look for plans offering return of premium, riders, flexible payouts and extended coverage. You can buy early: Premiums increase with age, early purchase keeps coverage cost effective. Leverage digital platforms: Online comparison tools simplify selection and highlight tailor made options. Disclose all facts accurately: Full honest disclosure can avoid future legal disputes. Know your rights: Be aware of grievance redress channels and available oversight. Conclusion Term insurance India is entering a new era in 2025 with new term plans 2025 that are transparent, personalised, digitally driven and legally robust. As affordability, flexibility and user experience improve also these modern plans offer the best protection first approach suited to today’s families. However adoption lags due to awareness gaps. Policywings, by educating consumers and highlighting these innovations that can play a pivotal role in advancing financial protection across India.

...Introduction What’s the smartest financial decision you can make for your family’s future? Buy life insurance! With term life insurance policies, you get high coverage at affordable costs. But it’s also very common to find that premiums vary so much. Two people of the same age might pay different premiums or the price for a life insurance term plan may come out differently from what’s shown in the ads. This is because insurance companies use a structured method to calculate it. The premium amount is based on your personal profile, lifestyle habits and risk factors involved. The fitter and safer you seem, the less you pay. Read on to know how to make those numbers work in your favor. What Exactly Is a Premium? In simple terms, a premium is the price you pay to the insurance company for the financial protection that they offer. You can think of it like a subscription fee that you pay on a monthly or yearly basis and as long as you pay this fee, your life insurance plans will keep your family financially protected. If, unfortunately, something happens to you during the policy term, the insurance company pays the sum assured to your family. So, when you see a company advertising their term plan as “₹1 crore cover for just ₹500 per month,” know that the amount of ₹500 is your premium. But is this number fixed for all? Calculation is the most important part here. Key Factors That Decide Your Premium Insurance companies always calculate. They study a bunch of factors and refer to data to decide your risk level. If you are on a high-risk side, your premium will naturally be higher. Here are the top factors considered: Age– The Younger You are, the Cheaper the Premium Age is literally the first thing insurers look at. A person in their 20s will pay a much lower premium than a person in their 40s, even for the same coverage. This is because younger people are naturally healthier and there are lower chances of their death. Buying a life insurance term plan early is always cheaper. Health Condition– What’s Your Medical History Insurance companies often ask for health details or even a medical test before they issue term life insurance policies. A person with conditions like diabetes, high blood pressure, heart issues, or some other serious illnesses is at increased risk. A healthy and fit person will pay less and the one with pre-existing health problems will pay more. Lifestyle Habits– Smoking, Drinking etc Smoking is never liked by insurers and they charge smokers up to 40–60% more than non-smokers for the same life insurance plans. Similarly, those who consume excessive alcohol also face higher premiums. The reason is simple. These habits tend to shorten life expectancy and increase insurer’s risk. Occupation– What’s Your Nature of Work? People with a regular office job are considered at low risk. Those who work in high-risk jobs (like mining, construction, armed forces etc) will be charged higher premiums. After all, these professions involve greater danger to life. Policy Term and Coverage Amount In providing longer term plans, the insurer is taking a risk for more years and so, they cost more. Similarly, a higher sum assured means a higher premium. But at the end, term insurance remains the most cost-effective way to get large coverage. Gender– Women Often Pay Less Stats show that women live longer than men and so, the premiums for women under life insurance term plans are often slightly lower. Yes, men of the same age and health profile have to pay extra. Family Medical History Insurers may charge more if genetic diseases run in your family like heart issues or cancer. However, if your family history is clear of illnesses, you may most likely enjoy lower premiums. Add-On Benefits (Riders) Riders add an extra protection. Accidental death cover, critical illness cover, or disability benefit are very useful but they also increase the premium. A term plan with a critical illness rider will be more expensive than a plain policy with the same coverage amount. Let’s take an example to understand premiums. Varun, age 25, buys life insurance term plan of ₹1 crore for 30 years. The annual premium is ₹8,000. Abhishek, age 40, buys the same policy for 20 years. He pays ₹22,000 per year. Here, Abhishek pays almost 3 times more for the same coverage. Why? Because he wasted so many years waiting. It shows how age and health are such big factors in premium calculation. How Do Insurers Actually Calculate? Let’s make things very simple for you to understand. So, all insurance companies use “mortality tables”. These are data banks of statistical information that is all regarding life expectancy. In this, they look at: The age bracket you fall in Chances of survival at different ages Risk factors, if any, like smoking, diseases or occupational hazards They use this data to calculate the total cost of covering you. On top of it, they add in extra charges for expenses, riders and profit margins and that’s how it’s decided what your final premium will be. So, for example the company is calculating the car insurance amount. Now, the premium of a person with a clean driving record will obviously be less than that of someone with a history of accidents. Why Premiums Differ Between Companies As it ever happened that you found out that one insurer is offering a life insurance term plan for a lesser price than the other for the “same” cover? Yes, it happens because: Not all insurers use the exact same data and assumptions. Some may also offer lower premiums to attract more customers to buy. Some insurance plans have built-in benefits that just make the plan costlier. That’s why it’s always recommended to compare life insurance plans before signing up for one. How to Keep Your Premium Low: Useful Tips Buy Early– Don’t wait for your later years. The younger you are, the less you pay.

...Introduction Business Owners Policy India and BOP insurance provide a streamlined, cost effective safety net for small and medium enterprises. In India, where operational risks range from property damage to legal liability, a business owner’s policy provides flexible coverage and strong compliance making it the perfect choice for companies wishing to combine several insurance policies under one roof. Understanding the Scope of a BOP Insurance for Indian Businesses Typically, a Business Owners Policy combines necessary business coverages into a single, specially designed product that is adapted to the complex requirements of Indian commercial enterprises. In general, these bundles include: Property insurance protects tangible assets such as structures, equipment, supplies and fixtures. Liability insurance that guards against third party claims of harm or property loss brought on by company operations. BOP insurance offers simplified administration, affordable premiums and improved clarity by combining these essential protections; this is particularly beneficial given India’s heterogeneous regulatory and sectoral environment. Property Coverage: Protecting Business Infrastructure and Inventory Property insurance is the foundation of a BOP. It protects material assets from dangers like fire, theft, rioting, natural disasters and other disasters. These include business buildings, plant and machinery, equipment and stock. Insurers have to precisely define covered perils, exclusions and valuation techniques in compliance or accordance with India’s General Insurance Business Regulations and Compliances. To prevent claims frictions it is important for the businesses to make sure that the policy wording clearly defines all the covered risks (e.g. fire and related hazards, flood, storm and burglary) and also specifies the valuation bases (e.g. indemnity, replacement cost or market value). Realistic asset values and policy limits that are in line with day to day operational realities are essential components of a legally sound policy. Liability Coverage: Shielding Against Third Party Claims In order to protect against third party claims for property damage or bodily injury resulting from routine business operations, liability protection under a BOP is essential. A duty of care is emphasised by India’s tort laws and statutory provisions, which hold companies liable for negligence even in routine operations. Usually, BOP provisions pay for settlement sums, medical bills or legal defence costs. The policy must be in line with the operational scope of the business because liability landscapes vary, ranging from small offices to manufacturing setups or shopfront locations. Systematic, efficient orequitable claim settlements are made sure by clearly stating the limitations, exclusions (e.g. professional liability) and claim procedures. Business Interruption Coverage Costly revenue interruptions can result from disruptions caused by fire, flood or other hazards. Business interruption coverage, which compensates for lost revenue and covers short term relocation or replacement costs while operations are resumed, is how BOP insurance handles this. Clearly stated indemnity triggers, waiting periods and the duration of coverage are essential given India’s regulatory emphasis on equitable settlement practices. Companies should verify whether the policy accounts for increased expenses during downtime and whether it determines loss based on actual earnings or projected operational income. Additional or Optional Add Ons in BOP Insurance Insurers in India may provide additional modules to enhance protection even though the standard BOP framework combines property, liability and business interruption coverage: Equipment Breakdown Cover: Guards against electrical or mechanical malfunctions. Cash or negotiable instruments stored on site are protected by money and securities insurance. Employee dishonesty: Protects against dishonest behaviour by staff members. Glass Damage: Protection against harm to windows or fixtures made of glass. Extensions for Natural Disasters: Adding coverage for cyclones or earthquakes where necessary. It depends on the industry and the main exposure profile of the company. These options may be beneficial whether it is a professional office, cafe, small manufacturer or textile retailer. To promise or guarantee enforceability and transparency it is advisable to make sure or confirm that any add ons relevant to the regulations set forth by the Insurance Regulatory and Development Authority of India (IRDAI). Legal Regulatory Framework Clarity and transparency in a policy is important in Indian insurance jurisprudence. Courts interpret ambiguous terms against the insurer by applying the contra proferentem principle. Uncertain exclusions, for instance, weakened insurer’s positions in cases like United India Insurance Co. Ltd. v. Lotus Petrofils (P) Ltd., leading to rulings in favour of the insured. BOP policies must therefore state: Well defined covered hazards and specified exclusions (e.g., hostile fire, unseaworthiness, standard exclusions). Conditions for valuation claims in order to ensure predictable and enforceable indemnity, particularly for stock and property. Succinct, clear definitions of “premises”, “business interruption,” and other key terms. The policy’s legal integrity is strengthened by making sure these components comply with insurer disclosure requirements under the Insurance Act and related regulations as well as IRDAI mandated product filing standards. Evaluating BOPs for Coverage Suitability in India Indian companies, whether they are small manufacturers, retailers or service providers, should evaluate coverage in relation to their unique risk profile, geographic location and legal requirements when contemplating a business owner’s policy. Important things to think about are: Location and exposure of the business, such as areas vulnerable to earthquakes, floods or high theft rates. Accurate asset values are necessary to establish suitable boundaries. Operational sensitivity and continuity requirements, particularly in cases where disruptions have a significant impact on profitability. The way third parties interact shapes the risk of liability. Legal soundness, unambiguous contract language, IRDAI compliance and matching coverage to actual exposures rather than merely meeting regulatory minimums should be the main topics of an informed discussion with insurers. The Strategic Value of a BOP Insurance Policy For Indian businesses looking for comprehensive risk management effectiveness, a well designed BOP insurance plan can be a valuable strategic asset. Businesses can gain from more transparent terms, consistent coverage and possibly lower combined premiums by combining several essential coverages: property, liability, business interruption,and optional extensions under a single policy. A business owner’s policy can be transformed from insurance into a governance tool with clear content, regulated product filing and legally sound wording. It protects corporate continuity from routine

...