Group travel

Group Travel Insurance

When traveling, the more, the merrier always applies. However, if you are traveling in a group, it is advisable to purchase group travel insurance that covers everyone. Group travel insurance is a must for travelers looking for basic coverage and for groups who want the benefit of purchasing a single plan. Group travel insurance is suitable for groups participating in a business trip, volunteering, or attending a class reunion. In this way, you can protect yourself from unexpected problems.

Here’s everything you need to know about group travel insurance before you buy one.

What is Group Travel Insurance?

Group travel insurance protects a group of people who travel together without any medical or other travel-related issues. Thus, if there’s a medical emergency, baggage loss, or financial crisis during travel, the group travel insurance policy will cover everything. Generally, group travel insurance is purchased by any organization or group where more than 5 people are traveling together. One major benefit of getting group travel insurance is that it can be more pocket friendly than purchasing individual travel insurance policies for every single member of the group.

Types of Group Travel Insurance

Group travel insurance has various types, all of which are designed to meet the unique travel needs of different groups. The common types of group travel insurance are:

It is designed for companies that have employees who frequently travel for business. This type of insurance typically includes coverage for trip cancellations, emergency medical expenses, and other travel-related risks.

It is for school groups that are traveling domestically or internationally. It provides coverage for medical emergencies, trip cancellations, interruptions, and other travel-related risks.

It is for families who are traveling together. This typically includes coverage for medical emergencies, trip cancellations, or interruptions, along with other travel-related risks that are distinctive to a family.

Sports teams traveling domestically or internationally for tournaments or other sporting events can get sports team travel insurance. It will provide coverage for medical emergencies, sports-related risks, trip cancellations, and more.

The policy is designed specifically for groups that take cruises together. It provides coverage for all medical emergencies, trip cancellations, and other cruise-related risks.

Why Do You Need Group Travel Insurance?

With globalization, the amount of people traveling has increased, and exposure to international locations has also increased. People travel for both work and leisure purposes. Indeed travel is fun but while traveling you can also come across various risks even when you are traveling in a group. In such times, having group travel insurance can come as a rescue and you can travel without any worries.

What Are the Features and Benefits of Group Travel Insurance?

Group travel insurance has lots of benefits that make it suitable to buy while traveling in groups. Still, the most prominent benefits of group travel insurance are:

- The insurer will compensate you for the expenses incurred due to an accident or other medical emergencies that occurred while traveling abroad.

- Emergency medical costs will be reimbursed for the expenses insured due to an accident while traveling in India only.

- The policy covers emergency travel costs for your family, medical repatriation or transfer of medicines, etc.

- Another essential feature of the policy is that during an overseas trip, be it business or leisure, you will get coverage for emergency medical deportation.

- The policy will prevent you from incurring extra expenses because of a flight cancellation. As an employer, it’s a must to choose the biggest possible claim, like the expenses for pre-paid activity.

- Travel insurance also pays for the loss of checked-in baggage, baggage delays, etc.

- For some reason, if your trip gets interrupted, your travel insurer will pay for the travel or accommodation expenses.

- Travel insurance is less expensive compared to what individual travel insurance costs.

- Getting group travel insurance is a hassle-free process as it covers multiple people in one policy with minimal paperwork.

What does a Group Travel Insurance Policy Cover?

A group travel insurance policy gives coverage for various risks that can occur during travel. However, coverage may vary depending on your insurance provider and policy. Some of the common coverages provided by group travel insurance are:

- Trip Cancellation

Travelers with prepaid and non-refundable trip payments can insure their expenses against trip cancellation. This way, you will get 100% trip cost protection. - Medical Emergency

The medical benefits of travel insurance can cover travelers in the event of a medical emergency that might occur during the trip, like illness or injury. - Travel Delay

If your trip is unexpectedly delayed for a significant amount of time, the travel delay benefit can reimburse meals and accommodate expenses. - Trip Interruption

The policy offers coverage to travelers who need to cut their trip short for specified reasons, such as illness, injury, or severe weather at the destination point.

- Medical Evacuation

Group travel insurance also covers the medical evacuation of a traveler to the nearest adequate hospital in case of an emergency during the trip.

How To File a Claim Under a Group Travel Insurance Policy?

If something unexpected happens during your trip and you want to claim it under your group travel insurance policy, then below are the steps mentioned that you need to follow:

- Contact your insurance provider as soon as possible. The insurance provider will give you information on how to proceed with the claim process.

- Your insurance provider will need certain documentation to process your claim. This will include medical records, receipts of expenses, and police reports.

- Submit the required documents. The insurance provider will review the claim and notify you of the outcome.

However, if additional information or documents are required or if there is any issue with the claim, it’s important to get in touch with your insurance provider so that you can ensure a timely settlement of the claim process.

Documents required:

– Travel Itinerary information

– Proof of travel

– Group information

– Medical information about people in the group

– Claim documents

To Sum Up!

However, opting for group insurance instead of individual coverage can save you thousands. Because disbursing a greater amount of claims than you would file for will decrease the premium. You can also negotiate with your insurance provider if you feel that they are offering an unreasonable quote for group policy cover.

However, if your group travels more than once a year, a multi-trip policy is the best option for you.

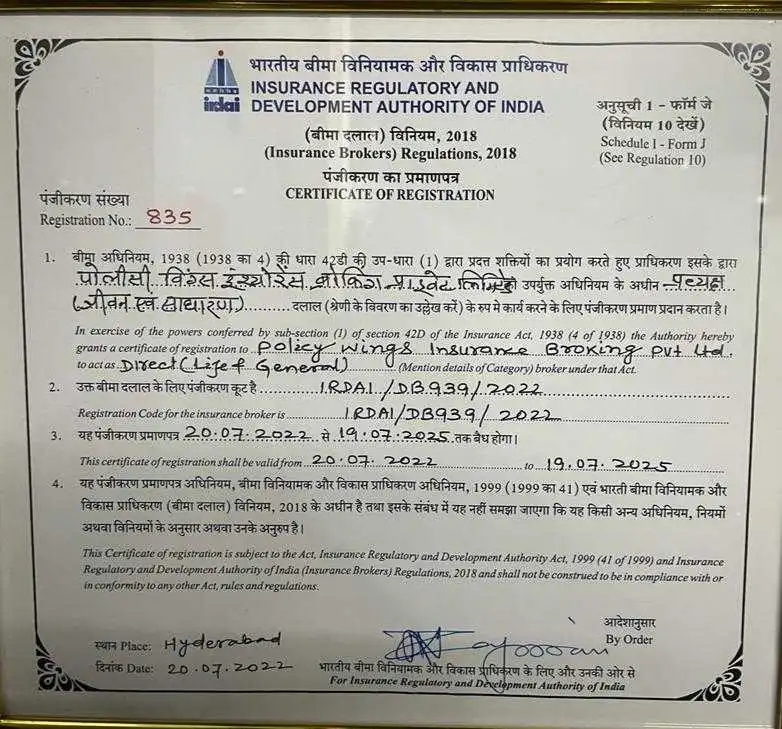

If you have any more queries regarding group travel insurance, Policy Wings is here to help. We are impaneled with all insurance companies and can offer you a variety of plans as per your requirements and budget, all under one roof.

Frequently Asked Questions

A travel insurance policy will cover a group of people traveling together. It functions the same way any other insurance group will, but the risk is divided among a larger group to compensate for the loss occurring while traveling.

While taking a group travel insurance, start by identifying the specific needs of the group, like the number of travelers, travel destinations, and duration of the trip. Then compare the policies from different insurance providers while paying attention to their coverage options, exclusions, deductibles, and premiums.

Yes, a group travel insurance policy is always cheaper than an individual travel insurance policy because the premiums per person for a group insurance policy are lower than the premiums for individual travel insurance.