All about Consumables Cover in Car Insurance

Getting car insurance while buying a car has become very common now. It’s good that people have started realizing the importance of insurance now.

Getting car insurance is like giving immunity to the car that you bought with your hard-earned money.

However, you might have come across the word “consumables” while getting car insurance.

Let’s talk about everything that is there to know about consumables cover in car insurance, what is covered under consumables in car insurance, and why they are important.

What Does it Mean by Consumables Cover?

Consumable covers are also mentioned as consumable reimbursements or consumable add-ons.

Consumable coverage is an optional feature that comes with a car insurance policy. It covers car parts that wear out over time or need to be replaced on a regular basis.

Now, no matter how comprehensive car insurance you buy, there are always some parts that are not covered. So, during the claim settlement process, the policyholder has to bear the cost related to car consumables.

These consumable car part replacements may appear to be inexpensive, but when purchased in bulk, they can burn a hole in your wallet.

But when a policyholder chooses consumable coverage along with the standard car insurance policy, the bank becomes liable to provide compensation even for the consumable expenses.

We understand that you are concerned about the cost of purchasing this add-on coverage, but let us assure you that it is a worthwhile investment that will save you a significant amount of money in the future.

Examples of Consumables

The consumables coverage provides insurance for all types of lubricants, oils, and other important items, like:

- Engine oil

- Power steering oil

- Brake oil

- Gearbox oil

- Radiator coolants

- Ball bearings

- AC gas

- Screws

- Bolts

- Grease

- Washers….and other important parts.

However, the consumables in the car can vary depending on the type and model of the vehicle.

Why are consumables not covered by car insurance?

I know you must be thinking of this question because I did too. After asking the experts in the insurance field, here is the answer-

The car insurance policies are designed to protect the car (asset) against accidents, thefts, or damage.

Because if you buy a car today and it is involved in an accident three days later, you will not be upset about losing a large sum of money. So car insurance is indeed good, as I said, it’s an immunity for your car.

However, consumable parts of the car require routine maintenance and are excluded from the standard car policy to prevent policyholders from filing small claims for car parts that are expected to wear out with time.

Which is quite understandable, right?

There are some limitations to car insurance

What if, you are on a family trip and, unfortunately, your car has an accident?

Your car now needs a repair worth, let’s say, Rs. 25,000. However, your car insurance policy only covers repairs up to Rs. 20,000.

This is because the remaining cost is for repairing and refilling consumables like engine oil and bolts. So, here, you have to pay the remaining Rs. 5,000 from your pocket.

Now, let’s just change the scenario a little.

This time, you also have consumable cover along with comprehensive car insurance.

In this case, the insurer will pay the entire amount of Rs. 25,000.

Thus, including consumables coverage in your car insurance policy will strengthen your standard policy and provide you with additional benefits.

Some Important things to consider while buying Consumables cover in Car Insurance

Now, there are some important points that you should keep in mind while adding consumables in car insurance policy, like:

- You can not obtain consumables cover if your car is older than 5 years.

- In the event of an accident or theft, the vehicle owner must repair the car’s consumables within three days to have the claim honored.

- If the driver is drunk, driving recklessly, or if car parts fail, the consumables claim cannot be filed.

- If you use a private vehicle for commercial purposes, you are not obligated to file a claim.

Besides, some other factors through which your consumable coverage can be rejected are:

- Wear and tear of car parts

- Mechanical or electrical failures

- Driving without a driving license

- Delay in informing the insurance company

To wrap up,

Having consumables cover in car insurance will prevent you from spending more money on repairs. And who doesn’t want to save money?

Also, if you own a luxury car, we recommend that you include consumables coverage in your car insurance policy because consumables are expensive in high-end vehicles.

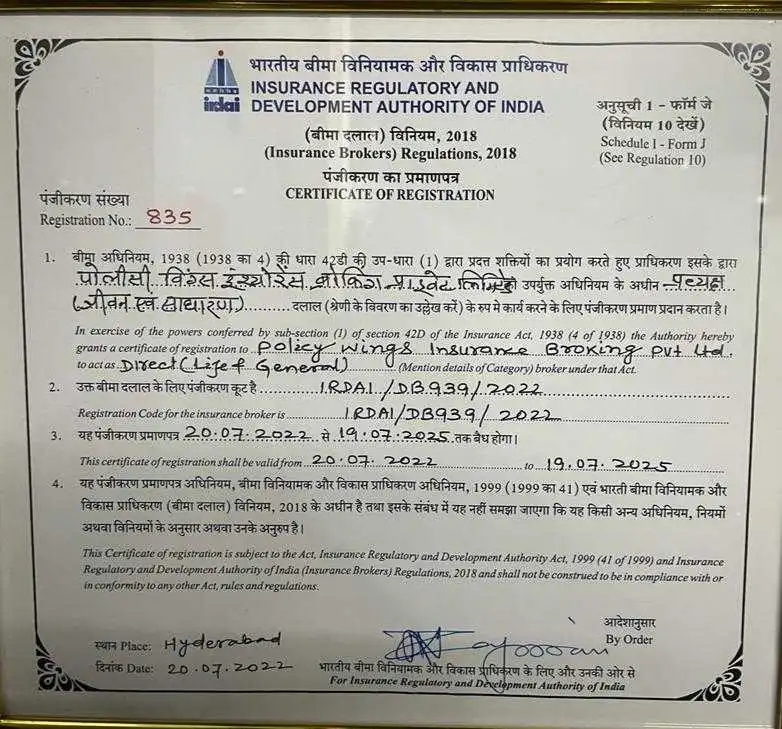

Moreover, if you are not sure where to buy consumables cover in car insurance or, in general, any motor insurance, then why don’t explore our PolicyWings website?

Or you can directly contact us to get insurance details.

Some Frequently Asked Questions

The consumable items in the case of car insurance are- brake oil, engine oil, lubricants, ball bearings, nuts, screws, bolts, and washers.

Consumables cover all types of oils and lubricants and also cover the expenses of AC gas, ball bearings, nuts, and screws.

Taking consumables cover in car insurance offers protection for all the expenses related to engine oil, brake oil, nuts, and screws. Having consumables cover in car insurance will prevent you from spending more money on repairs.

In typical car insurance, consumables such as fuel, brake fluid, air conditioning refrigerant, and additives are not covered. These consumable parts require separate expenditure during vehicle repairs or maintenance.

Consumable coverage in car insurance reimburses expenses for items such as engine oil, coolant, nuts, bolts, and screws used during post-accident repairs, lowering policyholders’ out-of-pocket costs.

To claim consumable coverage, a policyholder must submit several documents, including an original repair invoice with the consumable items specified, a receipt for the purchase of consumable items, a copy of the insurance policy, and any other documents requested by the insurance company.