Why Should You Get a Term Plan Insurance? Among all these financial plans, the future of your loved ones is the most crucial factor. Purchasing a term insurance plan is considered to be one of the finest ways to provide economic stability to your family in case of your sudden death. Term insurance is a variant of life insurance where the coverage is for a certain period or “term”. If there is a death during the period, the nominee gets the amount returned as death benefit. The following paragraphs would elaborate on reasons it is a smart decision to buy term plan insurance. Affordable Premiums for High Coverage Probably the most significant factor in favor of term insurance is its affordability. Term insurance is believed to have relatively low premiums as compared to other life insurance products. This will imply that one can purchase substantial coverage at an extremely low cost. If you happen to be young, then the premium will be extremely low, and this is considered a very good time to lock in your rate. Because term insurance is relatively inexpensive, you are able to provide for your family’s financial future without putting a dent in your current budget. Financial Security for Your Family The primary objective of a term insurance plan is to ensure financial security to your loved ones in one’s absence. The death benefit accrued to the nominee will amply help your family to continue with their current lifestyle, pay off debts, and meet day-to-day expenses. The lump sum amount, in many cases, can be utilized to meet major life events of your children, such as education or marriage. By investing in a term plan, you ensure that the financial needs of your family are taken care of even when you are not around to do it yourself. Coverage Against Liabilities Most people in today’s world have some financial liabilities related to home loans, car loans, or personal loans. These might turn out to be a huge liability on your family in case of your sudden death. A term insurance plan can help repay these liabilities so that your family does not face the financial strain of repaying debts. That is another important aspect of term insurance, especially when one has taken huge loans or mortgages; it helps alleviate the headache that your loved ones would be faced with after your demise. Flexibility in Policy Tenure Term insurance plans come with flexibility regarding the choosing of policy tenure. The best thing is that you can choose a term that will be in sync with your critical financial objectives, say, for the length of a home loan or till the time your children are financially independent. You get a good fit for your particular need, in other words. What’s more, some term plans allow you to extend the policy term or even convert your policy into a permanent life insurance policy as your needs change throughout the year. Tax Benefits Investing in a term insurance plan facilitates tax benefits provided under the Income Tax Act, 1961. The premium paid for the policy is considered for deduction under Section 80C of the Act and is allowed up to ₹1.5 lakh per annum. Further, the death benefit paid to the nominee is exempt under Section 10(10D). These benefits, therefore, make term insurance not only a tool to secure your family’s future but also to reduce your taxable income. Rider Options for Enhanced Protection Most of the term insurance plans include the option to attach riders or additional covers that extend the basic policy coverage. The common riders are critical illness cover, accidental death benefit, and waiver of premium. These riders can extend protection for those particular risks not covered under a basic term plan. You can customize your term insurance policy to offer comprehensive protection by opting for relevant riders. Simplicity – Transparency Term insurance plans are simple and thus easily understandable; hence, they are ideal for people seeking to get an insurance solution with no ifs and buts. In contrast to other types of life insurance policies, the term plans do not have a savings or investment component; hence, there are no complicated terms and conditions involved. Because of this simplicity and due to this transparency, it becomes quite easy for the policyholder to know where they stand and whether the policy meets all their expectations or not. Peace of Mind The biggest benefit of purchasing term plan insurance is the sense of security about life that it offers. It comforts you in knowing that your family will be financially secure even when you are no longer around to take care of them. Once you have a term insurance plan covered for your family, there is no stress related to their future. Conclusion Term insurance forms an important unit of sound financial planning. It so happens that it is highly cost-effective, flexible, and easy hence appeals to people in different walks of life. By investing in a term plan, you’re making that very vital stride towards securing your family’s future wherein your loved ones are protected against financial uncertainties pertaining to your untimely demise. So, do not wait; consider buying a term insurance plan today and give your loved ones a gift of security they truly deserve.

...Why Is It Necessary To Take Insurance? Imagine waking up one day to find that your car stolen, your home damaged by a sudden storm, or a medical emergency has left you with a hefty hospital bill to pay off. Life can sometimes be very scary and unpredictable, and while we can’t control the bizarre twists and turns it takes, we can ensure that we are protected from the financial fallout. This is where insurance steps in. It is more than just a financial safety net; it’s peace of mind, a superhero who can protect you against the unknown and make you feel safe in this world of uncertainty. In this blog, we explore why taking insurance isn’t just a smart choice—it’s a necessary step in moving on from the past, enjoying the present worry-free and safeguarding the future. Unexpected Challenges and High Costs Insurance is not just an option, it’s a financial necessity in today’s unpredictable world. From sudden medical emergencies and car accidents to unforeseen natural disasters or personal setbacks, life can throw unexpected challenges at you when you least expect them. These challenges often come with high costs like hospital bills, vehicle repairs, or property damage that can quickly drain you financially. Protecting Your Financial Stability Without proper insurance coverage, you could be left to bear the full brunt of these expenses, which could wipe out your savings, force you into debt, or delay other financial goals like buying a home or securing your retirement fund. By investing in insurance today, you’re essentially paying a small premium today to protect your future self. It acts as a shocker, protecting you from the bumpy ride of financial hits and offers long-term security, ensuring that even in the face of a crisis, you and your family can recover without any major permanent setbacks. Whether it’s life insurance securing your family’s future or health insurance helping you out with expensive medical bills, having the right coverage is key to maintaining financial stability in the face of uncertainty. Reducing Stress and Anxiety Insurance provides more than just financial protection; it offers peace of mind that can have profound emotional and mental benefits. Knowing that you are covered in case of emergencies relieves a significant amount of stress and anxiety, especially in situations where things could go wrong at any moment. Whether it’s the worry of a sudden illness, a car accident, or damage to your home, the assurance that you won’t be left to handle the costs can reduce the emotional burden. This peace of mind allows you to focus on the things that matter most to you- your health, your family, and your well-being, without being consumed by the fear of financial burdens. Life’s uncertainties often create anxiety, but insurance helps restore balance by offering a plan for when things go off course. You know that in the event of an emergency, there’s a system in place to help you recover without derailing your finances and your life. This emotional safety net is priceless, allowing you to live with confidence rather than constant worry and fear of financial ruin. Insurance isn’t just about safeguarding your money; it’s about protecting your mental and emotional well-being too. Beyond Financial Protection In a world filled with unpredictability, insurance is not just a luxury but a necessity. It goes beyond financial protection, providing an emotional cushion that allows you to face life’s uncertainties with confidence and peace of mind. Comprehensive Coverage for a Secure Future Whether it’s health insurance protecting you from unexpected medical expenses, life insurance ensuring your loved ones are cared for, or home and motor insurance shielding your valuable assets, the importance of having the right coverage cannot be overstated. Peace of Mind By investing in insurance, you are not only safeguarding your finances but also your future. It allows you to live freely, knowing that you have a safety net in place for life’s unforeseen challenges. So, as you move through life, don’t just think of insurance as a formality but view it as an essential part of securing your present and future, ensuring that no matter what happens, you’ll be ready to face it with confidence and calmness. After all, peace of mind is one of the greatest investments you can make.

...Types of Insurance Coverage Insurance Coverage: The saying- hope for the best and prepare for the worst is pretty much on point when it comes to practicality in life. We can never be sure of anything life throws at us, but we should keep ourselves ready with our shield in place. It is wise to choose to invest in insurance policies as they provide a safety net for our fall. Insurance plans are legal agreements between you and your insurer where they compensate you in case of loss damage or any other unfortunate suffering. In india there are two types of insurance- life insurance and general insurance LIfe insurance These plans require you to invest a fixed amount and pay a certain premium amount monthly, quarterly or yearly and in return they provide financial safety to you and your loved ones in case of your death or terminal illness. Your listed beneficiaries get to reap the benefits of this insurance plan after you. There are several types of life insurance policies that provide a range of options for your investment and financial stability. Endowment plans Like all insurance policies, the nominee of your life insurance policy reaps the benefits after you, but this plan can also act like a savings tool. The policy provides you with a maturity benefit, an amount you receive if you survive the term of the endowment plan, all including added bonuses. Term insurance As the name suggests, term insurance is similar but only lasts for a few years, a decade or two decades according to what you have chosen. Like a fixed deposit it keeps your invested amount safe and grows it as well and you receive the benefits of the term insurance plan as payout at the end of the term. Whole life insurance plans These plans are a bit expensive in terms of premium payment but the benefit is that they last for a lifetime- a 100 years and you do not have to worry about your policy renewal, which is a weight off your shoulder to start with. Whole life insurance plans are invested in with an angle of family financial coverage after you, so that after your demise your loved ones can claim the policy and look after themselves and your end of life care with the payout UIPLs Again, an insurance policy that covers your life but with twist, the premium you pay is distributed into two parts- savings and investment into the market. Through these types of plans you can be assured to have a safe savings amount but additionally and also an amount that grows with the market and your premiums. Pension plans The private sector is uncertain already, but with this insurance plan we can assure comfortable days in our old age. These plans have a certain tenure till you retire and then you receive a monthly payout out of the amount you have invested through your premiums, just like a pension. General insurance There are several aspects of your life that you can insure through these plans. Briefly, they are : Health insurance plans These insurance plans provide you with financial coverage for your health care and medical expenses. They are generally of two types- reimbursement plans or cashless claims. Both types cover medical expenses as far as the policy rules provide. Motor insurance This insurance plan provides financial coverage for loss incurred in an accident and other mishaps against your vehicle. Home insurance Home insurance as the name suggests is an insurance plan for your home in case of damage to your home be it man made or natural disaster. They provide financial coverage for contents in your house. Travel insurance Travel insurance is essential when it comes to long trips and provides financial coverage for any loss occurring during domestic or international travels, these losses could include flight cancellation, loss and damage of baggage, loss of passport, etc. It is to be kept in mind to always read the terms and conditions of your policy and stay in touch with the policy providers. All in all, investing in insurance plans is always beneficial!

...There is uncertainty at every step of the way in our lives. Now more than ever, Life insurance is a need. We have been able to cope and manage the stressors of life in various ways, and one of them is having a back up plan. You need a back up plan for your life as well, to ensure that the people you leave behind are cared for and safe. Life insurance policies provide full proof insurance of financial support in case of sudden demise of family members. Life insurance proves to be a safety net to save you from the hit your family and loved ones might take in case of death or disability of a family member. Life insurance not only covers the above stated, but also unforeseen circumstances like critical illness or permanent disability. When you’re insured you are assured that there will always be a shoulder to support your family, and that will be your insurer! There are few things life insurance helps us achieve, that is, protection of the family, investment for your future financial goals and most of all savings for your retirement plans and more. What is life insurance? It is a legally binding contract that promises benefit to the policy owner in case the insured person dies. The beneficiaries of the life insurance policy get the benefit, the insured sum, subsequent to the death of the person insured. It is structurally pretty easy to get a hold of. There is an assured amount that you pay to your insurer , a minimum basic amount you pay to get your life insurance policy started off. Now on that you pay the premium monthly or quarterly or annually depending on the type of insurance you have opted for. However there are some contingencies to keep in mind so that you know what you’re getting into. Firstly, life insurance depends on a few factors like age, gender, smoking habits, and the policy term. All of these factors your insurance premium amount varies according to the plausibility and probability of any unfortunate event happening. At the very basics, life insurance can be specified into two main classifications- term life insurance and whole life insurance. Apart from those two categories there are also- endowment plans, unit linked insurance plans, child plans, pension plans. Term insurance It is an insurance policy designed to last a certain number of years and then come to term and end. Usually the common terms are 10 years or 20 or 30 years. Term life insurance is a great tool to improve your financial stability as it gives a return at the end of the tenure. There are different types of term insurance as well. Increasing term life insurance helps your insurance as well as premium amount grow and is a great tool for investment purposes. Level term stays constant throughout the term, including your premium as well as assured amount Decreasing terms makes assured amounts of money decrease over time however the premium you pay remains constant. Whole life insurance This is probably the best policy to go for if you’re looking for the actual purpose of life insurance, meaning safety and coverage of your loved ones financial stability after you. You are required to pay the premium throughout your life starting at the time you started the policy. There are a few types of whole insurance as well ULIPs : These are different from the traditional whole life insurance but useful nonetheless, the premium amount you pay throughout your life is used for two things within this policy, mainly: firstly your savings and secondly investment in the market for the amount to grow. The traditional plan: when your policy reaches the end, you get its promised benefits These plans can be further divided into non-participating and participating categories. In the former case, the insured does not get any bonuses or dividends from the corporation. Benefits can be taken in one lump sum or as recurring payments. Endowment policy Within this plan if the insured person lives through the maturity period they get an added bonus or benefit. Just like the whole life insurance policies they can also be participating and non participating but here in you can get the benefits of investment in the market like ULIPs Money back policy This is probably on the more expensive side, however still absolutely worth is as the beneficiaries get the exact amount that you have invested in the policy Child care policies You can think of this policy like a safety net for your child. It helps you save for the future and provides the usual coverage, however they can be like endowment plans or UILPs the added advantage is that there is no bar on the age limit RETIREMENT PLANS This plan is , as the name suggests, a retirement plan. In such an economy and with the financial uncertainty we live with, it is only a valid concern that our old age shall be comfortable years to live through. These plans somewhat work like a pension, the policies you have invested in, their benefits you reap as monthly payouts to you after your retirement. These benefits can also be transferred to the nominee of your policy.

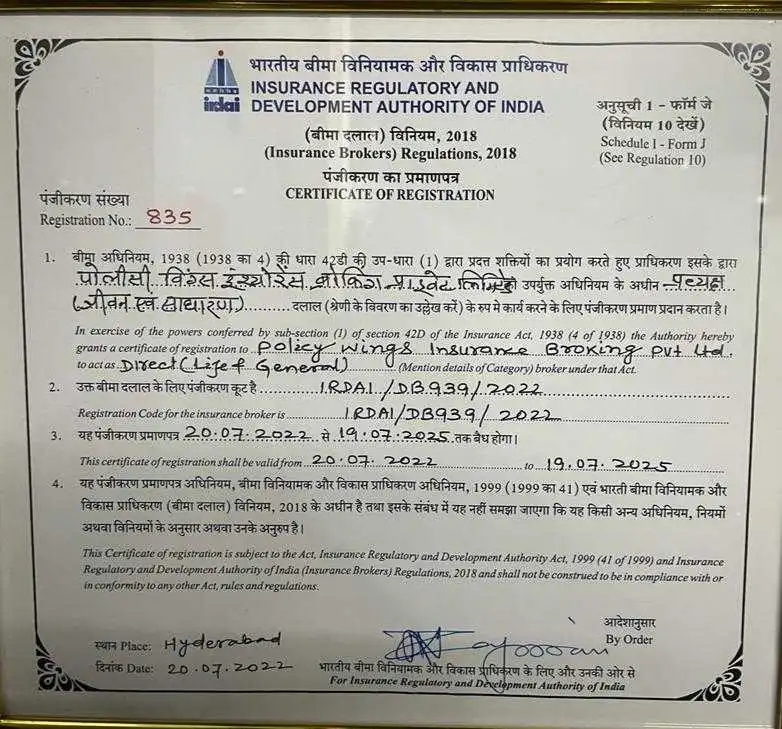

...We are always a bit unsure of what to invest in and what not to invest in, or how to go about doing exactly that. Credit this factor to the lack of awareness and knowledge or general uncertainty, irrespective, we are here to provide you with a clear view of how to manage such a situation, and how to go about choosing and investing in your very own life insurance policy. There are multiple coverage options for life insurance and choosing the right one for you is a task, come lets make it easier for you! But first let us look at what are the benefits of investing in an insurance policy. Since we already know life insurance policy is a great tool for investment, not only because it provides a range of options where you can choose what to do with your investec money, but also that it’s a burden off your shoulder once you’ve opted for it. They provide you with the financial coverage if you go through a terminal illness Since they’re long term you do not have to worry about choosing what to invest in constantly so you can live your precious years worry free. They obviously act as a money doubling strategy where as you grow your money grows with you. As the name suggests, not only you but your loved one reap the benefits later on as these plans reach maturity. Life policies are not taxable, so you get tax free financial returns and benefit These policies make up for lost time and income and provide help with end of life care. Now we have made it pretty clear why investing in a life insurance plan is logically and financially the wisest decision you can make. But these benefits only reach you once you decide and with a little leap of faith- and money. Step 1 Your first step should be to research the ideal insurance company you want to go for. Policywings provides an overview on the types of insurance policies as well, once you have a clearer picture of what kind of benefits you want to reap based on your age and number of members in the family, we move on to the next step. Step 2 Platforms like Policywings and policybazaar give you a clear picture with respect to various companies and their insurances, of different coverage amounts. Usually life insurance company have a detailed description of how your investment plan will work, and what percentage of the money you invest will reap you what percentage of benefits. Now choosing the right option is your decision to make. Step 3 A comparative analysis of the life insurance policy is essential, such platforms will also do that for you. It will give you a comparative analysis and all you have to do is look at other companies’ plans, and decide. Not just life insurance policy but life advice- keep your options open! Step 4 Now once you have chosen for a specific plan, you can go ahead and put all the necessary information the company asks you, birth date, gender, contact, nominee names and details, beneficiary names and details, aadhar details etc. Step 5 Lastly you make the payment online through net banking or whatever payment method you choose. Consequently you will receive the policy document on your registered email address. This document is extremely essential so keep it safe! Alternatively, there are other methods to go about buying a life insurance policy like you can go about it through a policy agent, or most banks offer life insurance policies as well, so talk to your banker just in case you discover new developments or improved plans. Always make sure to be thoroughly decisive and don’t be afraid to reach out to the company’s customer service providers in case you find yourself at an impasse.

...Homepage > Articles > Cyber insurance is a type of insurance which protects companies from the cost in the event of cyber attacks. It may cover the costs of recovering damaged files informing victims, and also providing surveillance of credit. The cost of insurance varies based on the dimensions of the business and also by the type of data that is at the risk. The higher revenue can also increase the cost of insurance, along with the history of a company’s cyber-attacks and the security measures that are implemented. What is Cyber Insurance cyber insurance type of liability insurance that shields companies from financial loss due to cyberattacks. It also helps businesses meet regulatory compliance requirements and legal obligations arising from data breaches. It also covers ancillary expenses such as hiring call centers to respond to customer inquiries, IT forensic costs, and public relations advice. It can even pay for the cost of acquiring and implementing new security measures. It’s important to note that cyber insurance is not a replacement for strong cybersecurity policies. In fact, it’s best to treat it as a complementary rider that reinforces existing defense plans. Many insurers will deny coverage if businesses don’t have multi-factor authentication, data encryption and zero trust policies in place. Financial institutions such as banks and credit unions often carry large volumes of sensitive client data. They are a common target for social engineering attacks that could result in unauthorized fund transfers or identity theft. They may also need to adhere to strict regulatory requirements. Cyber Security Insurance Cyber insurance can be described as a unique kind of liability protection that shields businesses from consequences of cyberattacks. It’s a booming industry which addresses the gaps in conventional insurance policies such as general liability, property and directors and officers protection. The insurance also covers the cost for repairing and remediating security breaches and ransomware attacks as well as other cyber-related incidents. Most insurers demand that businesses who are seeking cyber insurance have an effective security system in order to get protection. It could include multi-factor authentication and privileged access control (PAM) options, as well as endpoint detection and responses. Cost of cyber security is dependent on the nature and size of an organization in addition to the amount of technology used and amount of information that is sensitive. For example, a tax preparation firm might need more extensive cyber liability protection than an online bank, which is less dependent on technology. The insurance market is competitive, with dozens of providers competing for customers. Cyber Insurance Coverage Cyber insurance protects businesses from financial loss that is direct in the aftermath of an attack on their network. The policy reimburses for costs like the loss of data, recovery and recreation fees as well as the costs of public relations to restore an image damaged due to an incident involving data. Insurance may also be used to cover the damage that is affecting third parties which includes business partners and customers. It could include costs associated by a state-mandated response to data breach, monitoring services for consumers, and compliance for payment card companies penalties. The price of a cyberinsurance plan is contingent upon the size of the enterprise, the type of quantity of sensitive information as well as the dependence on technology. In order to lower costs businesses must practice the highest standards of security practices. This includes educating staff on how to spot suspicious emails and maintaining a strong password security program. It can also help to perform regular vulnerability assessments and conduct internal audits. Data Breach Insurance With data breaches becoming more commonplace and sophisticated, it’s important for every business to consider obtaining cyber insurance coverage. Often called a cyber risk policy or a cyber liability policy, it’s a type of first-party coverage that covers losses and damages caused by a breach. It typically includes legal defense and settlement costs, notification and restoration costs, lost revenue, and even extortion demands from ransomware attacks. It can also include coverage for the resulting fines and penalties from regulators. Any company that electronically transmits or stores confidential information or data is a potential target for a cyber attack. That includes retail businesses that process credit card transactions; accounting firms; online banking and brokerage services; health care providers; and many more. But small business owners are particularly vulnerable, with 60% of them closing within six months after a cyberattack. Cyber Liability Coverage As a result of evolving cyberthreats, demand for and cost of cyber insurance is increasing. Companies are using it to offset costs incurred due to business interruption, including loss of earnings and reputational damage. This type of coverage typically pays for legal expenses, a digital forensic team, credit monitoring services and crisis communications in case of a data breach. It’s especially recommended for retail and healthcare businesses that handle PII and PHI. However, there are several limitations to cyber liability coverage. It does not cover costs that are a result of infrastructure failures, and it does not address preexisting vulnerabilities or breaches. It also excludes losses that are caused by a failure to implement security protocols and procedures. These risks are covered by other insurance policies, such as professional liability. A typical cyber insurance policy offers first-party and third-party coverage. First-party coverage focuses on the insured organization’s financial impact and legal claims, while third-party coverage addresses liabilities that are a result of non-compliance with privacy regulations. Cyber Risk Insurance Policy A cyber risk insurance policy is a type of business insurance that helps pay for damages caused by cybersecurity breaches. Its coverage can include the costs of hiring computer forensics experts to recover stolen data, notifying customers and providing credit monitoring services. It can also cover legal fees levied by regulators. These policies are often supplemental to traditional business insurance policies, but they may be sold as standalone policies. A cyber insurance policy is especially important for logistics service providers, who have a heightened risk of being targeted by hackers because their business is predominately

...Homepage > Articles > Car insurance is more than just a legal requirement or another expense. It’s an investment in the safety and security of you, your passengers and other drivers on the road. Typically, a car insurance policy includes liability coverage for bodily injury and property damage. You can also add uninsured motorist bodily injury and uninsured motorist property damage coverage, which protects you in the event of an accident with an uninsured driver. Pay as you go Car Insurance Pay as you go car insurance, also known as usage-based auto insurance (UBI), is a new type of coverage that rewards safe driving by lowering rates. It works by using telematics devices to track how many miles you drive and your driving behavior. The device or app will typically sense more than just miles driven, such as speeding, harsh braking and phone use, and it will register good driving habits like daytime driving and staying on well-maintained roads. Besides mileage, the type and value of your vehicle, as well as its theft and crash risk, will affect the cost of your premium. Many insurers will offer discounts for low mileage drivers, but you should always shop around to find the best deals. There are a variety of companies who provide programs based on usage, such as Root, Progressive Snapshot, and Allstate Milewise. Each of them offers minimum state liability protection, and a few offer full coverage policies too. The programs typically require the use of a plug-in device, or a smartphone app to record your driving habits over the course of up to six months. Best Car Insurance Insurance for cars is an essential cost and is a crucial element of being a responsible motorist. Insurance can shield against costly repairs and financial strain when you are involved in an incident or theft. The top car insurance provides different levels of coverage and policies to meet the needs of your particular situation. The minimum amount of coverage that is required by the state of your residence usually is liability insurance for personal injury as well as property damage. To protect yourself further, think about complete coverage that includes collision and comprehensive coverage. Even with higher rates because of ongoing shortages and delays in shipping, Allstate is one of the leading car insurance providers that offer competitive rates and an array of services like Drivewise and Milewise with savings in premiums to ensure secure driving. Also, it has an excellent track record of customers’ satisfaction, and offers exceptional customer support. It offers a comprehensive portfolio and unique add-ons, including OEM coverage, rideshare coverage and diminishing deductibles. Affordable Car Insurance The best way to find affordable car insurance is to compare rates and coverage options. The cost of your policy will be influenced by several factors, including your driving history, the vehicle you drive and your location. Insurance companies may also consider your age and gender when determining rates. A good credit score and a clean driving record can lower your premiums. You can also reduce your rates by limiting the amount of collision and comprehensive coverage you buy. These types of coverage pay out based on your vehicle’s current value minus the deductible, so they may not be necessary for an older, less valuable vehicle. If you qualify for discounts, such as a good driver discount, bundling policies or going paperless, you can further lower your rates. You can also shop around for a cheaper policy by looking at smaller insurers that offer cheap car insurance in your state, such as American National, Auto-Owners and Erie. Compare Car Insurance There are many ways to compare car insurance rates, including online comparison websites and local insurance agents. Be aware that some online quotes may not be accurate, and some comparison websites are not unbiased, but rather lead aggregators that sell your information to insurance companies. If you do decide to use a website or agent, ensure that you are comparing apples-to-apples by selecting the same coverage options on each quote. Several factors can impact your car insurance rates, such as state requirements and your driving history. Insurers also consider the demographics of your driver, such as age, gender and marital status. On average, women are more likely not to create accidents, and thus will have lower rates than males. If you’ve got a poor driving record, like an at-fault crash or several traffic offenses the insurance premium may be more expensive than average. It is feasible to get a low-cost insurance through comparing insurance quotes. Cheap Car Insurance If you’re in search of cheap auto insurance, concentrate on obtaining the minimum amount of coverage that is required by the state you reside in. Also, you can get a lower cost by searching for special offers and bundle your car insurance along with other kinds of insurance such as life or home. Also, you should consider what kind of vehicle you use, because certain vehicles are more expensive to cover as compared to other models. People with a bad rating for driving might find it difficult to obtain affordable automobile insurance because they are viewed as riskier drivers. But, adding a new person to a family insurance policy could be an economical option, provided they’ve established their track history. It is important to compare to find the most affordable deal since some insurance policies appear low, yet they come with small coverage limits, or even high deductibles. Also, you can save on your insurance by completing a defensive driver training course, or by being a responsible driver. Third Party Car Insurance Third party car insurance (also known as CTP or green slip) is a mandatory liability coverage that every driver needs to have in Australia. While precise policy details vary by state, it generally covers your liability in a motor vehicle accident to anyone else up to a specified limit after you pay your deductible. It doesn’t cover any damages to your own vehicle unless the other party has CTP insurance. However,

...Homepage > Articles > Introduction In this fast-paced society that we live in, protecting our life and health is now a top priority. This article examines the reasons why life insurance as well as health insurance are important, with a particular attention to Indian market. The nuances involved in India health insurance as well as life insurance is crucial to make educated decisions to protect your financial well-being as well as your health. Health Insurance in India: A Comprehensive Overview The country of India’s Health Insurance has been an integral part of planning finances. It helps pay for medical expenses to ensure that individuals, as well as families have access to quality health care without worrying about finances. In the case of health insurance in India, there are a variety of options to meet various needs and requirements. Types of Health Insurance Plans in India Individual Health Insurance: The individual health insurance plan provide insurance for one policy holder. The insurance ensures that medical expenses are covered, giving security during illnesses. Family Health Insurance: Family health insurance provides protection to the entire family within a single insurance plan. It’s an affordable option to safeguard the well-being and health of those you love. Group Health Insurance: The group health insurance plan is created to help companies provide insurance for their employees. It encourages a healthy work atmosphere and addresses employees’ medical requirements. Buy Health Insurance Online The age of digital technology has changed how we buy insurance. The purchase of health insurance in India is now an easy process thanks to internet-based websites. Customers can look at various plans, evaluate options, and make smart selections from their homes. Vehicle Insurance: Safeguard Your Assets on the Road Alongside medical insurance, making sure you’ve got the security of your vehicle is just as important. It doesn’t matter if you’re purchasing a brand new insurance policy, or renewing an current coverage, understanding the various options is essential. Buy Car Insurance Online: Streamline the Process for Consumers Thanks to the ease of the internet, purchasing auto insurance online is now an everyday thing. People can research different options, review quotes, and select a plan that is compatible with their requirements. This is a simple method to protect your car and ensure that you are in compliance with the legal requirements. Understand Life Insurance: A Lifelong Commitment to Financial Security Life Insurance is a long-term obligation that provides financial insurance to your family members in case an unfortunate event occurs. It is a vital part of your financial plan to ensure that your family’s financial stability is secured. Life Insurance Plans: Tailored for Different Needs Term Life Insurance: Term life insurance protects your life for a specified period of time. It’s a great method of ensuring financial security for the duration of the policy. Whole Life Insurance: Life insurance that covers for the entire life of the policy holder. It comes with a savings feature that makes it a complete financial instrument. Endowment Plans: Endowment policies combine life insurance and savings. They can provide benefits at maturity in the event that the policyholder lives to finish the period. Aspire Car Insurance: Tailoring Coverage to Your Needs The Aspire insurance for cars is specifically designed to address the requirements of those who are looking to have a comprehensive insurance protection. It is more than just basic coverage by offering extra features and protection benefits to provide greater security while driving. Closing Words Insurance for life and health aren’t just instruments for financial gain. They are instruments that enable families and individuals to live safe and fulfilled lives. Understanding the details of health insurance policies in India and buying insurance online knowing the specifics of the life insurance choices help you make informed choices which are in line with your individual demands. When we face life’s uncertainties and the world, insurance is the foundation that supports our dreams and guarantees a better, safer, more secure, and prosperous future.

...Homepage > Articles > Life is full of uncertainties, and ensuring the financial security of your loved ones is a top priority. One-Time Payment Term Insurance, often referred to as “Single Premium Term Insurance,” is an insurance product designed to offer comprehensive protection with a single upfront payment. In this comprehensive guide, we will explore the world of One-Time Payment Term Insurance, its significance, advantages, considerations, and why it can be an excellent financial safeguard for you and your family. What Is One-Time Payment Term Insurance? One-Time Payment Term Insurance is a type of life insurance policy that provides a death benefit to your beneficiaries if you pass away during the policy’s term. What sets it apart from traditional term insurance is that instead of paying regular premiums throughout the policy term, you make a single lump-sum payment at the outset. This means that your coverage is secured from day one without the need for ongoing premium payments. https://www.youtube.com/watch?v=omQ4DtDR7Ag How Does It Work? The mechanics of One-Time Payment Term Insurance are relatively straightforward. You pay a single, substantial premium amount to the insurance company, which then provides you with coverage for a predetermined term, typically ranging from 10 to 30 years. If you pass away during this term, your beneficiaries receive the death benefit, which is often a tax-free lump sum. However, if you outlive the policy term, there is no payout, and the policy expires. The Significance of One-Time Payment Term Insurance One-Time Payment Term Insurance holds immense significance for various reasons: Immediate and Complete Coverage The most notable advantage of this insurance type is the immediate and complete coverage it provides. With a single premium payment, you ensure that your loved ones are financially protected right from the start of the policy. There’s no need to worry about missed premium payments or policy lapses. Simplicity and Convenience One-Time Payment Term Insurance is known for its simplicity and convenience. You make a single payment, and your insurance coverage is in effect. This can be particularly appealing if you prefer a hassle-free approach to managing your insurance. Liquidity Preservation By opting for a single premium payment, you can preserve your liquidity and maintain control over your financial resources. This can be advantageous if you have a lump sum of money available but don’t want to tie it up in regular premium payments. Estate Planning For estate planning purposes, One-Time Payment Term Insurance can be a valuable tool. The death benefit can help cover estate taxes and ensure that your heirs receive their inheritance intact. Investment Potential Some One-Time Payment Term Insurance policies offer cash value or investment components. This means that your lump-sum premium payment can potentially grow over time, providing a source of savings or investment return in addition to the death benefit. Advantages of One-Time Payment Term Insurance 1. Immediate Coverage With a single premium payment, you secure immediate coverage, providing peace of mind for you and your loved ones. 2. No Ongoing Premiums Unlike traditional term insurance, there are no ongoing premium payments, making it easier to manage your finances. 3. Estate Planning Benefits One-Time Payment Term Insurance can be a valuable tool for estate planning, helping to cover estate taxes and ensure the smooth transfer of assets to heirs. 4. Investment Potential Some policies offer the opportunity for your premium to grow over time, potentially providing additional financial benefits. 5. Flexibility These policies often offer flexibility in terms of coverage duration, allowing you to choose a term that aligns with your specific needs and goals. Considerations When Opting for One-Time Payment Term Insurance While One-Time Payment Term Insurance offers numerous advantages, several considerations are crucial when deciding if it’s the right choice for you: 1. Initial Premium Cost The single premium payment can be substantial. It’s essential to evaluate your budget and financial circumstances to ensure you can comfortably make this payment. 2. Policy Term Select a policy term that aligns with your needs and goals. Consider factors such as the age of your dependents, outstanding debts, and future financial obligations. 3. Investment Component If your policy includes an investment component, be aware of how it works and the potential returns it offers. Understand the associated risks and benefits. 4. Coverage Amount Determine the appropriate coverage amount that adequately addresses your family’s financial requirements, including debts, living expenses, and future needs. 5. Health and Lifestyle Factors As with any life insurance policy, your health and lifestyle can impact your eligibility and premium rates. Be prepared for medical underwriting and disclosure of relevant information. Conclusion One-Time Payment Term Insurance offers immediate and complete coverage, simplifying the process of protecting your loved ones financially. With a single premium payment, you can enjoy the advantages of hassle-free insurance, liquidity preservation, and investment potential. However, it’s essential to carefully evaluate your financial situation, policy terms, and coverage needs to make an informed decision. One-Time Payment Term Insurance can be a valuable tool for estate planning. Related Posts How to Compare Different Health Insurance Plans Online? How BMI Affects Health Insurance Premium Travel Insurance: Valuable Investment for Travellers FAQs Who Should Consider One-Time Payment Term Insurance? One-Time Payment Term Insurance is suitable for individuals with a lump sum of money available who want immediate and complete coverage without the hassle of ongoing premium payments. What Is the Ideal Policy Term for One-Time Payment Term Insurance? The ideal term depends on your specific financial goals and obligations. Consider your family’s needs, outstanding debts, and future expenses when choosing a term. Can I Add Riders to One-Time Payment Term Insurance? Some insurance providers offer riders that can be added to enhance your policy. Common riders include critical illness coverage and accidental death benefits. Are There Tax Benefits to One-Time Payment Term Insurance? In many cases, the death benefit from One-Time Payment Term Insurance is tax-free. However, tax laws can vary, so it’s advisable to consult with a financial advisor. What Happens if I Outlive the Policy

...Latest Blogs

How to Choose the Right Business Insurance for Your Industry? Running a business is a rewarding venture, but it also comes with risks. Whether you’re a small startup or a large corporation, business insurance is essential to protect your assets, employees, and ultimately, your business. However, insurance needs can vary significantly depending on your industry, and choosing the right coverage can be overwhelming. In this blog, we’ll break down how to choose the right business insurance for your industry, ensuring that your company has the tailored protection it needs to thrive, even when faced with unexpected challenges. Understand Your Industry’s Specific Risks The first step in choosing the right insurance is understanding the risks unique to your industry. For example, a construction company faces different challenges than a retail store, and a healthcare provider has risks that don’t apply to a tech startup. Knowing your industry’s common liabilities will help you determine which types of insurance are suitable for you. Retail and Manufacturing: Businesses in this sector may need commercial property insurance to cover theft, fire, or vandalism, and general liability insurance to protect against customer injuries on the premises. Professional Services: Lawyers, consultants, and accountants may need professional liability insurance (errors and omissions insurance) to cover potential negligence claims. Determine Legal Requirements Certain types of insurance are mandatory depending on the industry and your location. Ensuring compliance with local laws is crucial for running a successful business. For example: Workers’ Compensation: Most jurisdictions require businesses to carry workers’ compensation insurance to cover medical expenses and lost wages for employees injured on the job. Professional Liability Insurance: In sectors like law, medicine, and accounting, this coverage is often legally required in various jurisdictions. Research the specific insurance regulations for your industry to ensure you’re meeting all legal obligations. Evaluate Your Business Assets Your business assets include physical property, equipment, intellectual property, and even your reputation. The right insurance coverage should protect the key elements to protect your assets. If you own or lease commercial space, property insurance covers damage to your building, equipment, and inventory due to incidents like fire, vandalism, or natural disasters. With the rise of cyber threats, businesses that handle sensitive data (such as customer information) should consider cyber liability insurance to protect against data breaches, hacks, or phishing attacks. Consider Liability Coverage Liability is one of the biggest risks businesses face, regardless of industry. Whether it’s customer injury, product malfunction, or professional mistakes, liability insurance protects you from costly lawsuits and claims. General Liability Insurance is essential for most businesses and covers third-party claims of bodily injury, property damage, and legal defence costs. Manufacturers and retailers should consider product liability insurance to protect against lawsuits resulting from defective products. Professional Liability coverage is essential for service-based industries and covers claims of negligence, errors, or failures in your professional services. Account for Business Size and Growth The size of your business and future growth plans should influence your insurance decisions. A small startup may only need basic coverage, but as your business grows, so will your exposure to risks. Make sure your insurance policy evolves with your business. As businesses expand, unexpected events like natural disasters or a fire can halt operations. Business interruption insurance can cover lost income during these periods, ensuring you can recover without financial strain. For larger businesses or those expecting rapid growth, umbrella insurance provides additional liability coverage beyond the limits of your standard policy. This is especially useful if your business faces a high risk of expensive lawsuits. Review the Insurer’s Industry Experience Not all insurers are equal, and some specialize in certain industries. Working with an insurance company that has experience in your field can be beneficial. They will understand the unique challenges your business faces and offer tailored solutions. Look for insurers that offer specialized policies for your industry. For example, a technology-focused insurance provider may offer better cyber liability coverage than a general provider. Research the insurer’s reputation, especially regarding their claims process. A company with a smooth, customer-friendly claims process will save you time and stress when you need to file a claim. Bundle Policies for Better Coverage and Savings Many insurers offer the option to bundle different types of policies, which can save money while ensuring comprehensive coverage. Some insurance providers allow you to choose specific coverage types that fit your business needs. Review and Adjust Coverage Regularly Business needs change over time, and your insurance coverage should reflect that. Regularly reviewing your insurance policies ensures that you’re not paying for unnecessary coverage and that you have adequate protection as your business grows or evolves. Conduct a periodic review of your insurance policies, adjusting coverage limits or adding new types of insurance as your business landscape changes. Working with an experienced insurance advisor can help you assess whether your coverage is still suitable or if it’s time to make changes. Conclusion Choosing the right business insurance isn’t just about meeting legal requirements, it’s about safeguarding your business from potential risks that could impact your operations and profitability. By understanding your industry’s specific risks, assessing your assets, and choosing tailored policies, you can ensure your business has the protection it needs to succeed. Take the time to evaluate your business insurance needs carefully, and consult with an insurance expert if needed. With the right coverage, you can focus on growing your business with confidence, knowing that you’re prepared for whatever comes your way.

...General Liability Insurance vs. Professional Liability Which Does Your Business Need? Running a business involves a lot of moving parts, and protecting your business from potential risks is a key priority. Among the many considerations is ensuring that you have the right insurance coverage. Two commonly confusing types of insurance are General Liability Insurance and Professional Liability Insurance. Both serve different purposes, and choosing the right one or determining if you need both can have a significant impact on your business. Let’s take a closer look at the differences between the two and help you decide which coverage best suits your business needs. Understanding General Liability Insurance General liability insurance provides coverage for claims that involve bodily injury, property damage, or advertising injury resulting from your business operations. It acts as a safety net when your business activities lead to accidental harm or damage to others. This insurance is particularly relevant for businesses that interact with the public, such as: Retail stores Contractors Restaurants Event planners For example, if a customer slips and falls on your business premises or if your equipment causes damage to a client’s property, general liability insurance can cover legal fees, medical costs, and potential settlements. General liability insurance is like the all-rounder in your insurance toolkit. It covers a broad range of issues, primarily focused on accidents or injuries that happen on your business premises or are caused by your business. It’s typically used for claims involving: Bodily injuries (like the slipped customer) Property damage (like that unfortunate sign) Advertising injuries (accidentally using someone’s intellectual property in your marketing) In short, if your business interacts with the public in any way, general liability insurance is a must. It provides a financial safety net if someone sues you for injury or damage that happens due to your business operations. What Is Professional Liability Insurance? On the other hand, professional liability insurance often referred to as errors and omissions (E&O) insurance, covers claims related to the professional services your business provides. This type of insurance is designed for businesses that offer advice, expertise, or specialized services. If a client claims that your professional advice or services caused them a financial loss due to negligence, errors, or omissions, professional liability insurance provides coverage for legal defence costs and damages. Think of it as coverage for “uh-oh” moments when things don’t go as planned. A few examples: You’re a consultant and give advice that leads to a client losing money. You’re a graphic designer, and a client is unhappy with your final design because it didn’t match their brief. You’re a lawyer, and a client feels your services weren’t up to par, resulting in a financial loss. Professional liability insurance steps in to cover legal fees and any settlements or judgments made against your business if you’re sued for negligence or mistakes in your work. Which Insurance Does Your Business Need? Choosing between general liability and professional liability insurance or determining if you need both depends on the nature of your business. The short answer? It depends on the nature of your business. If you’re in a profession that provides services or advice like a consultant, lawyer, accountant, designer, etc., you’ll definitely want to invest in professional liability insurance. Since you’re being paid for your expertise, even a small error or perceived mistake could lead to a costly lawsuit. If your business deals with the public whether through a brick-and-mortar shop, a construction site, or public events, you’ll want general liability insurance to protect against accidents and injuries that might happen on-site or because of your business operations. What if you need both? It’s not uncommon! If your business both provides services and involves public interactions (e.g., a marketing agency that hosts client meetings in-house), you may need both general liability and professional liability insurance to fully protect yourself. Evaluating Your Risk and Coverage Needs Understanding the potential risks associated with your business will help determine the most appropriate insurance coverage. Here are a few questions to consider: Does your business have physical premises where accidents could happen to third parties? Do you provide specialized services or advice that could lead to financial or reputational damage for your clients if something goes wrong? Are you required by contract or law to carry specific types of insurance to conduct your business? Taking these factors into account will give you a clearer picture of the type of insurance you need. Conclusion Both general liability insurance and professional liability insurance serve important but distinct roles in protecting your business. By carefully considering the nature of your business operations, potential risks, and client interactions, you can determine which type of coverage is right for you or if a combination of both is necessary. Ultimately, consulting with a trusted insurance advisor can ensure that you make an informed decision and secure the protection that best aligns with your business’s specific needs.

...Business Insurance for MSMEs vs Large Enterprises: Key Differences When it comes to protecting your business, insurance is like that invisible safety net you hope you’ll never need but are glad you have. Whether you’re a thriving MSME (Micro, Small, and Medium Enterprise) or a massive enterprise, insurance is crucial for safeguarding your operations, assets, and future growth. But here’s the kicker, not all insurance policies are the same. MSMEs and large enterprises have unique needs, and that means their insurance plans differ in terms of coverage, costs, and customization. Let’s break down the key differences so that you can better understand what suits your business, no matter the size or scale! Coverage Breadth: Comprehensive vs. Focused Large enterprises tend to have much more complex operations, and their insurance needs are accordingly broader. They usually require comprehensive coverage that includes a wide range of protections, from employee liability, product recalls, and cybersecurity to global property insurance. These businesses typically operate across different regions or countries, meaning they need insurance that covers their diverse global operations. On the other hand, MSMEs usually need more focused coverage. These businesses typically stick to fewer products or services and operate locally or regionally. An MSME may not need the extensive global property coverage that large corporations do but would benefit from tailored packages such as property insurance, general liability, or professional indemnity insurance. They often opt for industry-specific policies, which can reduce unnecessary costs. While large enterprises go for “everything under the sun” insurance, MSMEs can focus on policies that target their specific pain points. Cost of Premiums: Scaled Pricing Let’s face it, the bigger the company, the higher the insurance premiums. Large enterprises pay significantly more, and while this might seem daunting, there’s a reason. Their larger footprint and higher risk exposure, due to the number of employees, clients, and regions they serve justify the higher costs. Plus, they may require multiple policies for the various aspects of their business. For MSMEs, insurance is usually more affordable, and there are often bundled policies tailored specifically to small businesses that combine multiple coverages into one manageable package. Larger businesses pay more because they have more at stake, but MSMEs can find affordable solutions tailored to their smaller-scale operations. Customization and Flexibility Here’s where the difference in size of the corporation starts to really show. Large enterprises often have entire teams dedicated to risk management. They will work closely with insurance providers to tailor policies, and they frequently require customization to address their specific, and often complex, risks. MSMEs, however, may not have the resources or time for such bespoke policies. But the upside is that they can usually opt for simpler, pre-packaged insurance policies that are easier to manage and understand. Many insurance companies offer MSMEs straightforward coverage options, knowing that small businesses need protection without the hassle of managing too many moving parts. Large enterprises customize heavily, while MSMEs benefit from more straightforward, ready-made solutions. Risk Management Resources Large enterprises often have access to advanced risk management tools. Insurers may provide services like regular risk assessments, on-site evaluations, or even access to specialized risk consultants. These businesses need to mitigate risks across various departments, be it HR, cybersecurity, or product liability. In contrast, MSMEs don’t always have such extensive resources. However, they are increasingly benefiting from digital tools that insurers now offer, like online risk assessments or easy-to-use platforms for tracking claims. While they may not need a full-time risk manager, these digital solutions can help them stay on top of their risk exposure. Big businesses often get the white-glove treatment for risk management, but MSMEs are gaining access to simplified, digital solutions. Claims Handling and Service Support Imagine you’ve suffered a loss, maybe a fire or a product recall. When it comes to claims handling, large enterprises usually receive personalized claims support due to their high premiums and long-term relationships with insurers. They may even have dedicated teams that liaise with insurance companies to ensure smooth claims processing. MSMEs may not have that level of personalized service, but many insurers now offer faster, more efficient claims processes tailored to smaller businesses. Some companies provide MSMEs with self-service portals where claims can be filed quickly online, significantly reducing the headache during an already stressful situation. Both large enterprises and MSMEs are seeing improvements in claims handling, but larger companies get more dedicated support. Regulatory Requirements Larger companies often have stricter regulatory requirements, especially if they operate in multiple countries or industries that require compliance with specific laws. For instance, a multinational corporation in the pharmaceutical industry would need insurance that covers the liability arising from strict regulations. MSMEs, especially those operating domestically, might not face the same level of regulatory scrutiny. However, they still need to ensure they’re meeting local insurance regulations, like workers’ compensation and general liability, depending on their industry and the number of employees. Larger companies navigate a more complex regulatory landscape, while MSMEs focus on meeting local or industry-specific insurance requirements. Conclusion While both MSMEs and large enterprises need insurance to protect their business interests, the scale, complexity, and specific needs of their coverage can differ dramatically. For small business owners, insurance is often about managing costs and getting the essentials in place. Large enterprises, meanwhile, require a more strategic and all-encompassing approach. Whether you’re running a small café or a multinational tech company, understanding your unique business insurance needs will go a long way in making sure you’re protected from life’s unpredictable moments.

...5 Key Insurance Policies Every MSME Needs to Protect Their Business Introduction An often-overlooked aspect of running a successful Micro, Small, or Medium Enterprise (MSME) is ensuring that the business is adequately protected from unforeseen risks. As MSMEs navigate unpredictable market dynamics, changing regulations, and operational challenges, safeguarding the business becomes more critical than ever. One powerful way to mitigate risk is by investing in the right insurance policies. From covering potential liabilities to protecting physical assets, insurance is a vital safety net for business continuity and financial stability. In this blog, we will explore the 5 key insurance policies every MSME should consider to ensure comprehensive protection. Understanding and implementing these insurance solutions can help your business weather unexpected disruptions while focusing on growth and innovation. General Liability Coverage General Liability Coverage protects MSMEs from third-party claims related to bodily injuries, property damage, and personal or advertising damages occurring on business premises or due to business operations. This policy is essential for safeguarding against lawsuits, legal fees, and potential settlement costs. It also covers medical expenses for injuries sustained by customers or clients on the business property. Whether you own a retail store, office, or warehouse, General Liability Insurance ensures that your business is protected against unexpected liabilities, providing financial security and peace of mind in the event of accidents or claims. Business Interruption Insurance Business Interruption Insurance provides MSMEs with financial protection when an unexpected event, such as a fire or natural disaster, disrupts normal business operations. This policy covers lost income and operating expenses, including payroll, rent, and utilities, during the recovery period. By compensating for lost profits, Business Interruption Insurance helps businesses maintain financial stability and recover more quickly from temporary closures or operational disruptions. It ensures that even if your business faces an unexpected halt, it can continue to meet its financial obligations and minimize long-term damage. Commercial Property Insurance Commercial Property Insurance safeguards the physical assets of an MSME, such as buildings, equipment, inventory, and furniture, against losses caused by fire, theft, vandalism, natural disasters, or other unforeseen events. Whether you own or lease property, this policy ensures your business can recover quickly from damage or destruction, minimizing financial loss and downtime. In addition to covering repairs or replacement of damaged assets, this insurance can also extend to loss of income resulting from property damage, allowing MSMEs to maintain continuity during recovery periods. Cyber Liability Insurance Cyber Liability Insurance protects MSMEs from the financial impact of cyberattacks, data breaches, or other digital security threats. As businesses increasingly rely on technology, they become more vulnerable to hackers, ransomware, and data theft. This insurance covers the costs of legal fees, notification of affected customers, credit monitoring services, and data recovery following a cyber incident. In an age where cybersecurity is critical, Cyber Liability Insurance ensures that MSMEs can mitigate financial losses and reputational damage, providing a crucial layer of protection against the evolving landscape of digital threats. Professional Liability Insurance Professional Liability Insurance, also known as Errors and Omissions (E&O) Insurance, is crucial for MSMEs offering professional services or advice. It protects businesses from claims of negligence, misrepresentation, or failure to perform services, which could result in financial loss for clients. Even if a claim is unfounded, legal defence costs can be significant. This policy ensures that professionals such as consultants, accountants, and service providers are protected against the financial consequences of errors, omissions, or professional mistakes, helping businesses avoid potential bankruptcy due to expensive legal battles. Conclusion In today’s ever-evolving business landscape, protecting your MSME from potential risks is crucial for long-term success. The right insurance policies act as a safety net, allowing you to focus on growth while mitigating unexpected disruptions. Whether it’s safeguarding against liabilities, protecting property, or ensuring business continuity during crises, these five key insurance policies provide essential protection. By investing in these policies, your MSME can remain resilient, secure, and prepared to navigate both opportunities and challenges that lie ahead.

...How to Protect Your Business Against Cyber Threats with Cyber Insurance? Introduction In today’s digital age, businesses of all sizes are increasingly vulnerable to cyber threats. From data breaches to ransomware attacks, the cost of cybercrime is rising, and traditional insurance policies often don’t cover these risks. This is where cyber insurance comes in. Cyber insurance is designed to mitigate the financial impact of cyber incidents, offering protection that goes beyond standard liability coverage. In this blog, we’ll explore how cyber insurance can safeguard your business and why it should be a critical component of your overall risk management strategy. Whether you’re a small startup or an established enterprise, understanding cyber insurance can help you stay resilient in the face of ever-evolving cyber risks. What is Cyber Insurance? Cyber insurance, also known as cyber liability insurance, is a type of insurance policy designed to protect businesses from the financial fallout of cyberattacks or internet-based threats. These incidents can range from data breaches, hacking, ransomware attacks, or any other form of cybercrime that affects a company’s operations, data, or customers. Unlike traditional insurance, which may not cover losses related to digital attacks, cyber insurance is specifically tailored to address the unique risks businesses face in the digital world. Coverage typically includes costs associated with data recovery, legal fees, notification to affected customers, credit monitoring for impacted individuals, and even public relations expenses to manage reputational damage. Cyber insurance policies can also help businesses recover from financial losses caused by business interruption, extortion demands, and regulatory fines resulting from data breaches. As cyber threats continue to evolve and become more sophisticated, cyber insurance provides an essential layer of protection, ensuring that businesses can respond effectively to incidents without being overwhelmed by the associated costs. Why do you need Cyber Insurance? Rising Cyber Threats: With the increase in cyberattacks, including ransomware and data breaches, businesses are more vulnerable than ever. Cyber insurance helps mitigate the financial impact of these threats. Financial Protection: Cyber incidents can lead to significant financial losses due to data recovery costs, legal fees, regulatory fines, and business interruptions. Cyber insurance provides coverage for these expenses, reducing the financial burden on the business. Customer Trust and Reputation Management: A cyber incident can severely damage a company’s reputation. Cyber insurance often includes crisis management services that help businesses manage public relations and rebuild customer trust after a breach. Legal Support: In the event of a data breach, businesses may face lawsuits from affected customers or clients. Cyber insurance can cover legal costs and settlements, protecting the company’s financial stability. Incident Response and Recovery: Many cyber insurance policies include access to a network of experts who can help businesses respond to incidents, including forensic analysis, data recovery, and public relations assistance. Business Interruption Coverage: Cyber-attacks can disrupt operations, leading to lost revenue. Cyber insurance can cover losses incurred during the downtime, helping businesses stay afloat during recovery. Peace of Mind: Knowing that there is financial protection against cyber threats allows business owners to focus on their core operations, fostering innovation and growth without the constant worry of potential cyber incidents. Choosing the Right Cyber Insurance Plan Choosing the right cyber insurance plan involves a thorough assessment of your business’s specific needs and risks. Start by conducting a risk assessment to identify potential vulnerabilities, such as the type of data you handle, your industry regulations, and your existing cybersecurity measures. Once you have a clear understanding of your risk profile, compare various insurance providers and their offerings. Look for coverage options that address your unique threats, including first-party and third-party liabilities, data breach costs, business interruption, and legal fees. It’s essential to read the fine print of each policy to understand exclusions and limitations. Additionally, consider the provider’s reputation, claims process, and customer support. Engaging with an insurance broker specializing in cyber insurance can also provide valuable insights and help you navigate the complexities of the coverage options available. Finally, ensure that the policy you choose not only meets your current needs but is also adaptable as your business evolves and the cyber threat landscape changes. Conclusion In today’s digital landscape, cyber insurance is essential for protecting businesses against the growing threat of cyber incidents. It provides financial coverage and resources to help mitigate the impact of attacks and support recovery efforts. By understanding the importance of cyber insurance and how to select the right policy, you can better safeguard your business and enhance your reputation among customers and stakeholders. Ultimately, investing in cyber insurance not only protects your bottom line but also fosters resilience in an increasingly interconnected world.

...How To File A Claim For Medical Insurance In India? Introduction Filing a claim for medical insurance in India can be a daunting task, especially if you’re unfamiliar with the process or dealing with a medical emergency. However, understanding the necessary steps and documentation can make the experience smoother and help you get the financial support you need. In this blog, we’ll guide you through the entire process of filing a claim under your health insurance policy, whether it’s a cashless claim or a reimbursement. What is health insurance? Health insurance is a safety net that helps cover medical expenses when you fall ill or face an unexpected health issue. It’s not just about saving money on hospital bills—having a policy gives you peace of mind, knowing that in a medical emergency, you can focus on recovery without worrying about the financial burden. Types of Claim Processes available in India Cashless– The cashless claim process allows you to receive medical treatment at a network hospital without paying out of pocket at the time of admission or discharge. Instead of paying upfront, the insurance company settles the hospital bills directly. To use this facility, you need to show your health insurance card at the hospital, fill out a pre-authorization form, and once the insurer approves it, your treatment expenses are covered under the policy terms, minus any exclusions or deductibles. Reimbursement– The reimbursement claim process involves you paying for your medical treatment upfront and then claiming the expenses from your insurance company. After you’re discharged from the hospital, you submit the necessary documents such as hospital bills, discharge summary, prescriptions, and other medical reports along with a filled claim form to your insurer. The insurance company will review your claim, and if everything is in order, they will reimburse the amount as per your policy coverage, directly to your bank account. Step by step guide on How to file Medical Insurance Claim Whether you’re opting for a cashless claim or a reimbursement claim, the process of filing a medical insurance claim in India can be made easy by following these steps: Understand what your policy covers Before initiating any claim, properly review your policy to understand what medical expenses are covered, such as hospital stays, treatments, medications, and any exclusions or waiting periods. Inform Your Insurance Provider Cashless Claim: Contact your insurance company as soon as possible, ideally before hospital admission, or within 24 hours in case of emergencies. Reimbursement Claim: Inform the insurer about your hospitalization and treatment soon after being admitted. Each insurer has a specific timeframe, so ensure you notify them within that window. Choose a Network or Non-Network Hospital Cashless Claim: Select a hospital from your insurance company’s list of network hospitals to avail of the cashless facility. Reimbursement Claim: You can choose any hospital (network or non-network), but you’ll need to pay upfront and file for reimbursement later. Submit a Pre-Authorization Form (For Cashless Claim Only) At the network hospital, present your health insurance card and fill out a pre-authorization form available at the hospital’s insurance desk. The hospital will submit this form, along with required medical details, to your insurer for approval. Get Approval from the Insurance Provider Cashless Claim: Once the insurance provider reviews the pre-authorization form, they will approve or deny the cashless claim. Upon approval, you don’t need to pay for treatment (excluding non-covered expenses or co-payments). Reimbursement Claim: There’s no pre-authorization here. Instead, focus on collecting all treatment-related documents. Collect and Organize All Required Documents (Both Claims) You should carry all the original documents which were used for the treatment like diagnosis reports, discharge Summary, bills/receipts, and medical reports/tests along with KYC and bank related documents for reimbursement claims. Submit the Documents Cashless Claim: The hospital typically handles this process once your treatment is completed, coordinating with the insurer directly. Reimbursement Claim: You need to submit all the collected documents to your insurance provider after discharge. Some insurers allow this to be done online, while others may require physical submission. Follow Up on Your Claim Stay in touch with your insurer for any updates or additional document requests. Most companies offer a claim tracking option through their website or mobile app. Claim Settlement Cashless Claim: Once approved, the insurer settles the bill directly with the hospital, and you only need to cover expenses not included in the policy (like non-medical items). Reimbursement Claim: After reviewing the documents, the insurance company will reimburse the covered amount directly to your bank account, usually within a few weeks. Conclusion Filing a medical insurance claim in India doesn’t have to be complicated if you’re well-prepared and know the steps involved. Whether you opt for the convenience of a cashless claim or the reimbursement route, understanding the process and having the right documentation can make a world of difference. By staying informed about your policy, acting promptly, and keeping track of your paperwork, you can navigate the claims process with ease. Health insurance is meant to reduce financial stress during medical emergencies, and with the right approach, you can fully benefit from the coverage your policy provides.