All About Health Insurance for Self-Employed Individuals

Health insurance for self employed individuals: Do you ever wonder how many individuals are opting for self-employment to carve out their own career path?

According to recent statistics, the number of self-employed individuals has been steadily rising, with over 15 million Americans now identifying as self-employed. Among the myriad of benefits that come with self-employment, such as pursuing personal passions and having greater autonomy, there lies a formidable challenge – securing adequate health insurance coverage.

While this path offers numerous benefits, one significant challenge that self-employed individuals face is securing health insurance coverage. Unlike traditional employees who often receive health insurance benefits through their employers, self-employed individuals need to navigate the complex world of health insurance on their own.

In this blog post, we will delve into the importance of health insurance for self-employed individuals and provide a comprehensive guide on what you need to know when it comes to choosing the right health insurance plan.

Why Health Insurance is Crucial for Self-Employed Individuals

Health insurance is of utmost importance not only for self-employed individuals but for everyone. However, for self-employed individuals, having health insurance for self employed individuals is even more critical due to the absence of employer-sponsored health insurance plans. Here are some reasons why health insurance is crucial for self-employed individuals:

- Protection Against High Healthcare Costs: Without health insurance, self-employed individuals may find themselves facing exorbitant healthcare costs in the event of an illness or injury. Health insurance helps mitigate these costs by covering medical expenses, ensuring that they do not have to bear the financial burden alone.

- Access to Quality Healthcare: Having health insurance provides self-employed individuals with access to a network of healthcare providers, ensuring that they receive timely and quality medical care when needed. It empowers them to prioritize their health and seek necessary treatment without financial barriers.

- Preventive Care and Wellness: Health insurance often covers preventive care services such as vaccinations, screenings, and routine check-ups. By availing these preventive services, self-employed individuals can catch potential health issues early on, leading to better overall health and potentially avoiding more extensive medical treatments in the future.

- Peace of Mind: Health insurance provides self-employed individuals with peace of mind, knowing that they are protected against unforeseen medical expenses. This financial security allows them to focus on their work without the constant worry of potential healthcare costs looming over them.

Understanding Health Insurance Options for Self-Employed Individuals

Self-employed individuals have several options when it comes to choosing health insurance coverage. Let’s explore some common health insurance options available to them:

- Health Insurance Marketplace:

The Health Insurance Marketplace, established under the Affordable Care Act, offers a variety of health insurance plans for individuals and families. Through the marketplace, self-employed individuals can compare different plans, consider their coverage needs, and choose one that fits their budget.

For example, a self-employed writer can visit the Health Insurance Marketplace website, enter their information, and review multiple plans offered by insurance providers. They can compare costs, coverage options, and benefits to select a plan that suits their needs.

- COBRA:

If you recently left a job where you had health insurance coverage, you may be eligible for COBRA continuation coverage. COBRA allows individuals to continue their previous employer’s health insurance plan for a certain period, albeit at a higher premium. This can provide temporary coverage until you find a more sustainable option.

An example would be a graphic designer who decides to leave their full-time job to launch their own design business. They can utilize COBRA coverage for a few months until they find a more affordable health insurance plan tailored to their new self-employment status.

- Association Health Plans:

Some professional or trade associations offer group health insurance plans for self-employed individuals who are members of the association. These plans may provide more affordable rates and coverage options compared to individual plans.

For instance, a self-employed photographer who is a member of a photography association can explore the association’s group health insurance plan to receive more affordable coverage options compared to purchasing insurance independently.

- Health Savings Accounts (HSAs) and High-Deductible Health Plans (HDHPs):

Self-employed individuals can consider pairing an HSA with an HDHP to save for medical expenses tax-free. HDHPs typically have lower premiums but higher deductibles, making them suitable for individuals who are generally healthy and want to save on premiums.

Imagine a self-employed artist who is in good health and rarely visits doctors. They can opt for a high-deductible health plan paired with an HSA to enjoy lower premium costs and have the flexibility to save money tax-free for future healthcare needs.

- Short-Term Health Insurance:

Short-term health insurance plans provide temporary coverage for individuals in between health insurance plans. While these plans offer limited coverage, they can be a cost-effective option for self-employed individuals during transition periods.

For example, a self-employed consultant who recently moved to a new city and is in the process of setting up their business can consider a short-term health insurance plan to bridge the gap until they are settled and ready to choose a long-term health insurance plan.

Tips for Choosing the Right Health Insurance Plan

Choosing the right health insurance plan can be overwhelming, but it is essential to consider several factors to make an informed decision. Here are some tips to help you choose the best health insurance plan for your needs:

Assess Your Healthcare Needs: Evaluate your medical history, anticipated healthcare needs, and budget when choosing a health insurance plan. Consider factors such as coverage, deductibles, copayments, and network providers to determine the most suitable plan for you.

Compare Plans: Research and compare different health insurance plans to find the one that offers the best combination of coverage and affordability. Pay close attention to cost-sharing structures, including premiums, deductibles, copayments, and coinsurance.

- For instance, compare the coverage and overall costs of multiple plans available on the Health Insurance Marketplace to understand which one aligns with your healthcare needs and financial capabilities.

Check In-Network Providers: Ensure that the health insurance plan you choose includes healthcare providers and facilities that are convenient for you. In-network providers typically have lower out-of-pocket costs compared to out-of-network providers.

- Consider the network of doctors, hospitals, and specialists associated with each insurance plan. This is crucial, especially if you have specific healthcare providers you prefer to work with or if you have any existing healthcare relationships you want to maintain.

Consider Additional Benefits: Some health insurance plans offer additional benefits such as telemedicine, prescription drug coverage, wellness programs, and mental health services. Evaluate these benefits to determine which plan aligns with your healthcare needs.

- For example, if you regularly need prescription medication, check if the health insurance plans you are considering offer affordable prescription drug coverage or any discounts on medication costs.

Understand Enrollment Periods: Be aware of enrollment periods for health insurance plans, as missing these deadlines may result in a coverage gap. Open enrollment periods for the Health Insurance Marketplace typically occur once a year, while you may qualify for special enrollment periods in certain circumstances.

- Mark your calendar and set reminders for open enrollment or special enrollment periods to ensure you have continuous coverage. Missing these deadlines may require you to wait until the next enrollment period or apply for an exemption.

Conclusion

After all is said and done, let’s entertain the idea for a moment – health insurance. It’s not just some exquisite item on the wishlist for us self-employed folks; it’s the real deal! So here’s the scoop – dive into the world of health insurance, unveil the treasure trove of options out there, and tap into the wisdom shared earlier. Armed with this knowledge, securing the right coverage for your well-being becomes

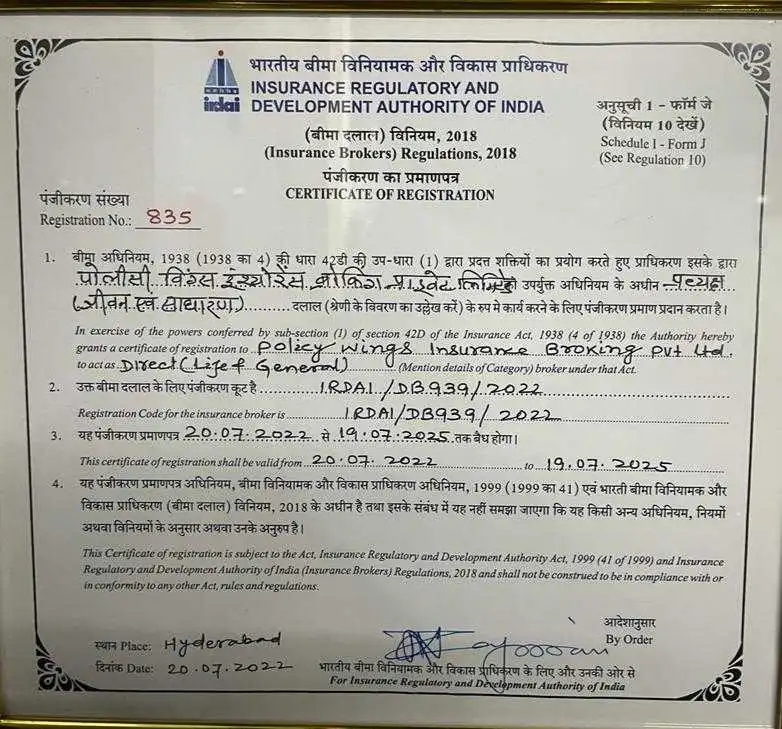

Ready to set more towards the realm of secure health coverage? Take the wheel, self-employed individuals, and consider contacting Policywings – your trusted companion in navigating the world of insurance!

Remember that health insurance is an investment in your well-being and financial stability as a self-employed individual. By making informed decisions about your health insurance, you can protect yourself from potential healthcare costs and enjoy the benefits of quality healthcare when needed. Prioritize your health and secure the right health insurance plan that suits your unique needs as a self-employed individual.