Best Health Insurance Companies

Best Health Insurance Companies

There is no question that, given the rising cost of healthcare in today’s society, buying health insurance is one of the most important financial decisions you can make. With medical inflation close to 14-15%¹ which is further expected to rise by the end of 2023, opting for adequate health insurance coverage is inevitable. It might be a bit of a challenge to choose the best health insurance provider in India since there are so many of them to choose from.

Every company has its own set of advantages and features that will make it possible for you to pick a plan that suits your financial situation as well as your objectives. A proper health insurance provider and a health insurance plan are of utmost importance in the current climate of high medical expenditure.

Health insurance provides protection against medical expenses, as well as cash protection in the event of a medical emergency.

When you choose the right medical insurance plan, you will be able to obtain tax benefits, reimbursements for medical expenditures, cashless hospitalization and much more. Moreover, the majority of health insurance providers provide additional benefits like free teleconsultations, discounts on gym memberships, and health check-ups, making them a cost-effective investment in your health and well-being. So, the importance of health insurance is quite obvious. However, when you opt for the best health insurance plan for yourself and your family, you need to conduct some research in order to choose a plan that will meet your budget as well as the requirements that are required of you.

Features of best health insurance companies in India:

- Claim Settlement Ratio:

It is important to consider this factor when assessing how reliable a company is. It describes the ability of an insurance company to resolve claims in a timely manner.

The claim settlement ratio is the percentage of claims that an insurance company settles as a percentage of the total number of claims that it has received. However, this data is not shared by the IRDAI. This is internal data published by each insurer. So, the higher the ratio, the better the credibility of the company. (Explained in detail below) - Hospitals Network:

Insurance companies have agreements with multiple hospitals whereby an insured person may be eligible for cashless treatment, and in such a case the insurer will pay for the hospital’s medical costs directly if the insured person qualifies.

In order to find the best hospitals in your surrounding area, you should consult the list of network hospitals in order to locate the preferred hospitals in your area. The right insurance provider should, ideally, have a large hospital network. - Solvency Ratio:

The purpose of this test is to determine if the assets of an insurance company are sufficient to cover long-term obligations and pay claims over the long run.

According to the IRDAI, every health insurance provider must maintain a minimum solvency ratio of 1:5, in order to be considered viable. Insurers with higher asset holdings have a greater solvency ratio as a result of having higher assets.

There will be a benefit to consumers because, in the event of mass claims, the firm will have sufficient funds to cover the claims of those consumers in the event of mass claims. - Annual Premium:

The total amount of premiums that a health insurance company receives in a given year is called its annual premium volume.

As a result of this information, you are able to get a better understanding of how much insurance the firm sells each year.

It is commonly used to measure the success of a company in terms of its profitability as well as its market share based on this volume. In addition, it can also be used to identify trends in the health insurance industry. - Variety of Plans available:

When you obtain a good or service without doing much research first, you are more likely to be interested in that good or service.

Therefore, before deciding to take a course of action, it is important to consider all possible options before making a final decision.

Providers of healthcare services offer a variety of plans that cater to the needs of their consumers either directly or indirectly. Make sure that you pick the one that is most suitable for your needs - Easiness of Claim and Customer Service:

Ensure you choose an insurance company that has a proven track record in the industry before you make a decision. This is usually evaluated by how good and efficient their claims settlement team is and their after-sales customer service.

The best way to evaluate the credibility of an insurance company is to check out its client testimonials and ratings in order to determine how reliable it is.

As a matter of fact, it is a well-known fact that insurance companies with a higher number of customers and a collection of positive reviews tend to be more reliable and have the resources to deal with claims in a timely manner.

Thus, when you choose the best health insurance plan for yourself and your family, you need to know all about the best health insurance companies in India and then choose accordingly.

What is CSR (Claim Settlement Ratio)?

This ratio is a measure of the number of claims that have been settled compared to the number of claims submitted; the higher the ratio, the better it is.

However, please understand that the claim settlement ratio is not the only aspect that needs to be considered. Other aspects that need to be considered along with the claim settlement ratio are how soon the claims have been settled, the amounts of claims settled instead of the number of claims settled, and the reasons for which the claims have been rejected or repudiated. Some of this data is shared by the IRDAI in their Annual Report.

Instead of considering the claim settlement ratio, as it is not publicly published data by the IRDAI, it is better to consider the number of claims settled by the insurer within 3 months.

For example, the claim ratio within 3 months for the Standalone Health Insurance companies as per the latest IRDA Annual Report 21-22 are:

- Aditya Birla Health Insurance Co. Ltd. 99.41%

- Care Health Insurance Ltd. 100%

- ManipalCigna Health Insurance Co. Ltd. 99.90%

- Niva Bupa Health Insurance Co. Ltd. 99.99%

- Reliance Health Insurance Ltd. 76.36%

- Star Health and Allied Insurance Co. Ltd. 99.06%

List of some of the best Health Insurance providers:

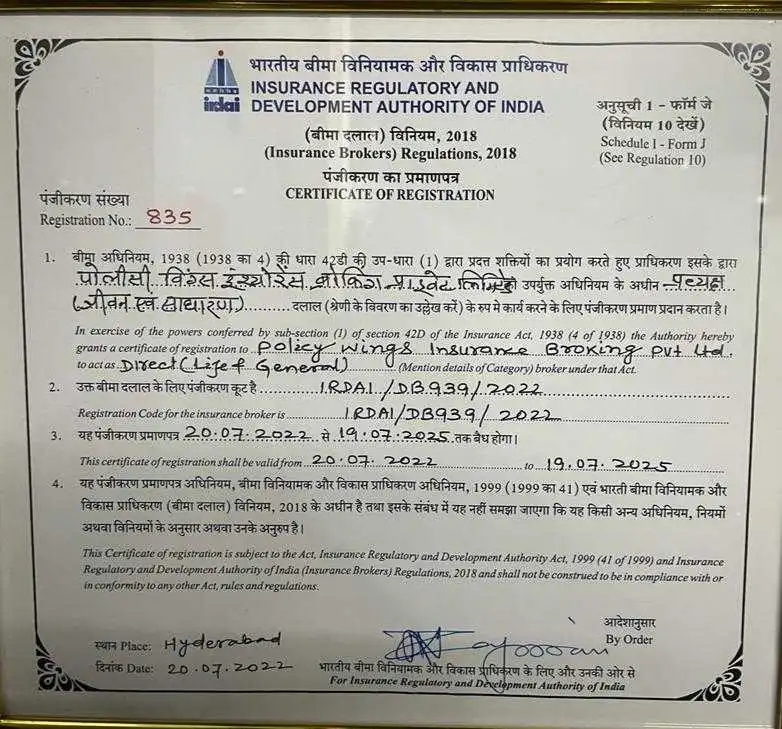

Each insurer is regulated by the IRDAI and hence it is not easy to rank them, as one company excels in one parameter while the other in another. Hence, we have listed the standalone health insurance companies in India:

- Aditya Birla Health Insurance:

Aditya Birla Capital Ltd.’s subsidiary is the Aditya Birla Health Insurance Company. It was established in order to make general insurance services for its clients easier.

a. The insurance provider offers cashless services in 650 Indian cities and more than 8700 hospitals

b. The insurance provider offers access to more than 800 gyms, yoga studios, and other services.

c. In addition, the policyholders are entitled to discounts on medications at 2300 pharmacies across more than 250 locations.

d. According to the selected plan, in-patient Ayush treatment insurance is also offered.

e. Along with hospitalization facilities, the insurance provider additionally offers access to wellness, diagnostic, and fitness examination services. - Care Health Insurance Company Limited:

This is India’s second-largest standalone health insurance provider. Their healthcare plan provides comprehensive healthcare coverage to its customers from advanced and modern treatments like radiosurgery, robotic surgery, etc.

a. There is a plan to suit all requirements, including individual and family floating plans, plans for those who have diabetes and high blood pressure, plans for older citizens, and top-up plans.

b. In almost all situations, the insurer provides cashless claim approval within two hours.

c. The majority of plans provide covered members with the option of yearly health examinations.

d. Care Health Care Heart plan is provided for previous medical histories and yearly heart exams. - Manipal Cigna Health Insurance Company Limited:

ManipalCigna Health Insurance offers a wide array of comprehensive healthcare plans that provide easy and lifelong access to quality healthcare. They have a firm belief that “Health Hai Toh Life Hai”

a. The company has received numerous awards for its performance. In 2021, Lifetime Health from the company won the “Product of the Year” award.

b. The company provides a variety of specially designed plans that may be altered to meet your requirements.

c. The premiums are reasonable, and the company’s extensive hospital network guarantees quick payment of cashless claims. - Niva Bupa Health Insurance Company Limited:

Trusted by more than 1 crore happy customers, Niva Bupa Health Insurance Company (erstwhile Max Bupa Health Insurance Company) is a joint venture with 10,000+ network hospitals.

a. Niva Bupa has a strong network of 10000 + hospitals.

b. They provide a Health Companion plan with smart features to give you everything you need in a health cover.

c. All claims are processed directly with no involvement of any third party.

d. They provide a wide range of health insurance plans to 1 crore plus happy customers that suit every need. - Reliance Health Insurance Limited:

Reliance General Insurance has a successful track record of helping people with the best-in-class assistance. They have health insurance policies offering coverage up to Rs.5 crore, more than 9,100 cashless hospitals, and a 98.6% claim settlement ratio.

a. It offers an array of health insurance plans at pocket-friendly prices and has a huge customer base consisting of individuals, families, and senior citizens.

b. The Company boasts of settling 98% of all the claims received.

c. Their plans offer comprehensive medical coverage against a variety of diseases and medical conditions. - Star Health and Allied Insurance Company Limited:

Star Health Insurance is the first standalone insurance company in India. Star Health Insurance offers a wide range of health insurance plans at an affordable premium.

a. The policies cover hospitalization expenses, medical check-ups, critical illnesses, Ayurveda treatment, etc.

b. They have more than 11000+ network hospitals where the insured members can avail of cashless treatment.

c. The company has been conferred with many awards and accolades such as Most Innovative New Product of the Year, in 2020.

d. Star Health Insurance Company has more than 1100+ network hospitals where the insured members can avail of cashless treatment.

Other than the standalone health insurance companies, there are quite a few general insurance companies that provide great health insurance plans which are quite popular in the industry. Some of the popular General Insurance Companies in India would be:

- National Insurance Company Limited:

The company offers more than 80 insurance services available for you & your family, and representatives of small and medium businesses and enterprises of many industries, corporations, holding companies, and financial groups.

a. With India’s top banks, the company has the largest Bancassurance partnership.

b. One of India’s oldest insurers, the business has an extensive clientele.

c. The company provides a variety of health insurance bundles with reasonable premium costs.

d. The Economic Times Best Brands Award has recently recognized the company. The “Healthcare Excellence Award” was also given to it in 2021. - SBI General Insurance Company Limited:

SBI General is one of the rapidly growing private general insurance companies, with the strong parentage of SBI. They have served over 34 crore customers & have the largest banking franchise in India.

a. With more than 23,000 State Bank branches and more than 5500 Regional Rural Bank branches, the company is well-represented across India.

b. The business provides health insurance options to customers, businesses, and even the SME sector.

c. In 2018, the company took up the Best BSFI Award.

d. SBI Has a robust model of multi-distribution comprising agency channels, broking, Bancassurance, and Retail Direct Channels along with various technological and digital tie-ups. - HDFC Ergo General Insurance Company Limited:

HDFC ERGO has been efficiently striving to make insurance easier, affordable, and dependable for the last 20 years. The company has won the “Claims and Customer Service Excellence” category of the FICCI insurance industry awards 2021.

a. More than a billion lives have been insured by the company so far.

b. The company offers you round-the-clock assistance for any sort of concern you may have.

c. 90% of cashless claims receive a response from the company within 20 minutes of notification. On the other hand, reimbursement claims are accepted within 3 days.

d. The company has released a wellness app that assists you in keeping tabs on your health and leading a healthy lifestyle.

e. In 2021, the business received the ETBFSI Excellence Award. - Universal Sompo General Insurance Company Limited:

Universal Sompo General Insurance Co. Ltd. is a tie-up of Indian Bank, Karnataka Bank Ltd., Dabur Investment Corporation, and Indian Overseas Bank, along with a leading general insurance company from Japan called Sompo Japan Insurance Inc. They provide a variety of products catering to the rural and retail markets with a focus on the SME segment and the segments of corporate customers.

a. The company has a high claim settlement percentage of over 90%.

b. The company received the Economic Times’ “Best BSFI Brands” Award for 2021–2022.

c. The company offers a wide range of health insurance plans that are suited for everyone.

d. They provide World-class services with a hybrid of Indian and Japanese Products. - The New India Assurance Company Limited:

The New India Assurance Company is one of the largest insurers in India with qualified and experienced staff across the country. They have a higher capital position and strong market position, they are the only company to have developed International operations and successful trading outside India.

a. The company has branches not just in India but also in 28 other nations across the world. Because of this, the business provides its clients with services of a high worldwide grade.

b. The company has a CRISIL rating of AAA/Stable.

c. The company’s financial data shows that it has a solid financial base. In March 2021, New India Assurance generated INR 31,573 crores in worldwide revenue thanks to its presence in 28 countries.

How do I choose a health insurance plan?

Making the best decision for your health and financial security by selecting the most suitable health insurance provider is crucial. The following measures can help you make a well-informed decision:

- Determine your requirements:

Start by evaluating your needs and limiting spending. Considering your age, your present health status, the medical history of your family, and any particular health issues you may have After choosing what you need, research various Indian health insurance providers. Information can also be gathered from friends and family who bought health insurance, as well as from online reviews, rankings, and feedback from customers. - Check the network of hospitals:

A health insurance company’s hospital network’s size and excellence are regularly used to determine its quality. Check to see whether or not the insurance provider provides a network of hospitals that you are comfortable with and can easily go to. - Evaluate the Claim Settlement ratio:

The percentage of the total number of claims that an insurance company settles in a given year is known as the claim settlement ratio. A high claim settlement ratio is an indication of a trustworthy and reputable insurance provider; hence, go for that insurance company. But this data could be skewed as it doesn’t specify the ease of claim and the time taken to settle the same. - Compare plans and policies:

Look at the policies provided by various insurance providers. Pay attention to exclusions, sub-limits, waiting periods, and copayments. Choose an insurance policy that is reasonable and corresponds to what you need. - Consult a specialist:

If you’re still not sure which insurance company you should select, see an expert who can guide you throughout the procedure and enable you to make a well-informed decision. - Customer service:

Lastly, evaluate the company’s customer service services. Ensure that they have a customer support team that is readily available to help you with any questions or issues related to your policy, 24 hours a day, 7 days a week.

Conclusion

Health insurance offers you a wide range of benefits, including pre-and post-hospitalization costs, cashless treatment, tax advantages, childcare costs, a no-claim bonus, daily hospital cash, lifelong renewability, and more. In addition, selecting the finest health insurance plan can be difficult without understanding the top insurance companies in India.

Frequently Asked Questions

The answer is that certain health insurance companies provide diabetic health coverage. Some of the insurers that will pay for insulin costs The plans that include insulin costs are the National Varishtha Mediclaim plan and the Star Health diabetic safe insurance plan.

No, only network hospitals offer cashless settlements. However, based on the conditions of your insurance, you can later get paid back for your costs.

The company's goodwill, the variety of plans and coverage choices offered, the claim settlement process, the network of hospitals and healthcare providers, and the overall customer service experience are all things to take into consideration when choosing a health insurance carrier.

Some health insurance companies include dental care. Some of the insurers that can cover dental costs are Bajaj Health Guard Insurance Plan, Cholamandalam Healthline Insurance Plan, Star Complete Health Insurance, etc.

Leading Health Insurance Companies

Latest Blogs

Car insurance in India plays a very crucial role in both legal and financial terms. It is made mandatory by the law to have at least a third party insurance. Additionally, it is advised to have comprehensive car insurance thereby reducing financial strain. The Motor vehicle market India has experienced a massive growth in the past few years. As of 2025 the Motor vehicle market India is valued at USD 13.19 billion. The car insurance segment in the market is valued at approximately USD 3.59 billion and might reach USD 4.39 billion by 2030. Nowadays everyone is looking for affordable car insurance India but it is challenging to find. Here we will discuss Affordable Car Insurance in India: Best Low-Cost Policies in detail. Understanding Car Insurance: There are several types of car insurance offered in India. Each offering a variety of services and covers. The two major types are listed below: Third Party Insurance: It is mandatory by the law to have at least a third party insurance which covers all the damages caused to others in accidents (e.g., injury or property damage). Comprehensive Car Insurance: It is advised to have comprehensive car insurance as it covers damages to your own vehicle under theft, natural disasters etc. Car insurance in our country is governed by the Motor Vehicles Act and the Insurance Regulatory and Development Authority of India (IRDAI). IRDAI regulates the promotion of insurance, regulates premium, ensures the safety of policy holders etc. You can search for cheap car insurance online and get insurance according to your requirements. There are some legal requirements for car Insurance in India: Third-Party Liability Insurance is Mandatory Renewal of Car Insurance Fitness and Pollution Control Check Penalties for Non-Compliance Factors Affecting Car Insurance Premiums: Age and make of the car: Older cars are likely to have a lower premium because of their reduced market value. Nonetheless if the car is older and more prone to breakdown, it might also affect the Premium prices of a car insurance based on the repair costs. Expensive, luxury and high Performance cars tend to have higher premium values. Location and usage of the car: Urban areas with heavy traffic rates, accident rates and risks of vandalism lead to higher premiums. Areas prone to natural disasters can influence premiums. Moreover, The premium might be lower for commercial vehicles as compared to personal vehicles because of the risk factor they carry. Driver’s age and driving history: Drivers under the age of 25, usually receive a higher premium whereas experienced drivers receive a lower premium due to their experience and awareness of driving. Add-ons and their impact on premiums: Add-ons in car insurance are additional coverage options that you can choose to enhance your basic insurance policy. Zero Depreciation Cover: The premium does increase but it has its share of benefits as well. No Claim Bonus (NCB) Protect: The premium increases minimally, it helps claim the NCB benefits reducing premium in future. Key Replacement Cover: The premium increases moderately, it helps with cars with advanced key systems and advanced features. Tips for Finding Affordable Car Insurance: Finding a perfect and affordable car insurance India can be a challenge, but there are some ways for getting low premiums with the same benefits. Don’t settle for the first quote you get, rather go around and compare quotes from multiple insurances giving a wide variety of options. Opting for Higher deductibles typically means lowering your premium, you just have to make sure you can afford the deductible in case of an accident. No claim bonus is a discount offered by the companies to the policyholders who didn’t make any claims in their last policy period. Availing NCB is considered a wise choice. Purchasing multiple insurance policies from the same insurer may result in heavy discounts and is convenient to manage. Top Affordable Car Insurance Policies in India: Bajaj Allianz: Bajaj Allianz offers comprehensive car insurance with third-party, own damage, and add-on coverage options like Zero Depreciation, Engine Protection, and Roadside Assistance. It provides cashless repairs, No Claim Bonus, and 24/7 support, ensuring wide protection for both the vehicle and third-party liabilities. Pros: Comprehensive Coverage Affordable Premiums Wide Network of Garages User-Friendly App Cons: Customer Service Complaints Limited Add-ons on Basic Policies Claim Settlement Time HDFC Ergo: Apart from third-party insurance, HDFC Ergo car insurance has insurance coverages for loss or damage to an insured vehicle due to theft, fire, or natural disasters. Add-ons under the policy can include Zero Depreciation, Engine Protection, as well as Roadside Assistance, to name a few. It is also respected for speedy claims settlement and features a wide network of more than cashless garages, making it a worthy proposition to have as a vehicle owner. Pros: Wide Network Flexible Coverage Options Customer Support Claims Process Cons: Premiums for Add-Ons Limited Customization How to Save on Car Insurance? Maintaining a good driving record and avoiding accidents and violations helps in keeping your premiums low and sustainable. With that you can take defensive driving courses to improve your driving skills. Adding anti-theft devices to your car is considered a very sensible choice as it provides safety to your car, as well as insurance companies offer discounts to policyholders with anti-theft devices installed in their car. Review your insurance regularly and update it according to your requirements, with that any update on information has to be notified to the insurance company within a short span for avoiding problems during claims. Conclusion: Car insurance is a financial cushion that guards policyholders against accident expenses, theft, and vehicle damages. It covers third-party liability and protection for your vehicle through collision or comprehensive policies. Policyholders can minimize premiums by maintaining a good driving record, using higher deductibles, having anti-theft equipment, and taking multiple policies. It’s good to check and renew your coverage from Policywings so that it goes on to match your requirements, providing you with the best cover. FAQs: What are the differences between third-party and comprehensive car insurance? Third party car

...Having a family health insurance plan is more crucial than optional because of current healthcare conditions. Your family needs financial protection from healthcare costs because unsafe conditions in our environment and diet affect how well medical care is understood and priced. Health insurance enables policyholders to maintain medical access without worrying about the expense of medical needs. As we arrive in 2025 health insurance providers start offering more helpful coverage with digital support and health prevention benefits. This article shows you exactly how to select the right life insurance plan for a family through clear explanations. Understanding Family Health Insurance What is a Family Health Insurance Plan? With a family health insurance plan all family members receive medical coverage through one insurance policy that protects them all. Under a single family health plan everyone living in the household benefits from a joint insurance coverage. How is it Different from Individual Health Plans? The plan insures one person with a specific amount of payment protection. Family Health Insurance protects several family members using the same insurance money. One family health plan costs less money than having separate insurance plans for each family member. Our plan lets you include newborn babies to your coverage without any additional steps. Key Benefits of a Family Health Insurance Plan Comprehensive Coverage: Covers hospitalization, daycare treatments, pre- and post-hospitalization expenses, and critical illnesses. Your family pays less when you purchase one medicinal coverage policy rather than individual plans for each member. One Health Policy Lets You Manage Payments and Expiration Dates Smoothly Favored members of insurance companies receive medical care services without using their own money at network hospitals. You can use the tax deduction of Section 80D from the Indian government toward your health insurance payments. Factors to Consider When Choosing a Family Health Insurance Plan Coverage Scope A useful family health insurance plan needs to provide complete protection through hospital stays combined with treatment in daycare facilities, maternal care services, and emergency transportation. Look for health insurance that has protection against serious health conditions as well as COVID-19 management and medical screenings every year. Premiums and Deductibles People usually prefer lower premiums but these plans include higher deductibles and reduced coverage. Compare insurance pricing with the plan benefits to make sure you get good value. Network of Hospitals and Doctors Verify that the insurance provider works with many hospitals that let you receive cashless medical services. You can get medical services at any moment because our wide network provides fast access to medical facilities. You can also check all the terms and conditions and the process of claiming your family health insurance as quickly as possible in case of any emergencies. Pre-existing Conditions and Waiting Periods The majority of medical insurance plans include specific time limits before covering preexisting medical conditions. When a household member handles an existing medical issue you should pick a plan that helps patients faster plus covers previous health problems better. Claim Settlement Ratio and Process The claim settlement ratio (CSR) indicates how many claims an insurer successfully settles. A higher CSR means a smoother claim process, reducing hassles during medical emergencies. Additional Benefits Look for added benefits such as free annual health check-ups, wellness programs, no-claim bonuses, and maternity benefits. These features enhance the overall value of your policy. Types of Family Health Insurance Plans Deciding on the best family health insurance needs you to grasp all available options first. Indemnity Plans vs. Fixed Benefit Plans Indemnity Plans: The plan pays your medical hospital treatment expenses based on your medical bills. Fixed Benefit Plans: These policies give you a guaranteed payment when you receive a specific illness diagnosis but do not base payments on your medical costs. HMO, PPO, and POS Plans HMO providers (Health Maintenance Organization) force customers to use selected medical service networks. PPO lets policyholders find doctors and hospitals from an expanded selection of providers. POS (Point of Service): A mix of HMO and PPO with additional referral-based services. Critical Illness Plans and Top-up Plans Critical Illness Plans: Provide lump-sum payouts for diseases like cancer, heart attack, and stroke. Top-up Plans: Enhance your existing health insurance coverage at a lower premium. Government-Sponsored vs. Private Insurance Plans Different government programs such as PMJAY (Ayushman Bharat), ESIC and insurance programs from states aim their support at people with particular income levels. Private Insurance: Private companies such as Policy Wings, offer customizable plans with broader coverage options. Tips for Comparing and Choosing the Best Policy How to Use Online Comparison Tools? Users find their suitable insurance product more easily when they see different options on Policy Wings compared to doing manual research. Checking Policy Exclusions and Hidden Charges Look carefully at policy exceptions to learn which conditions your coverage does not include like cosmetic surgeries, holistic treatments and existing health conditions before you start. Common exclusions include: Cosmetic surgeries Alternative therapies (unless specified) Specific illnesses during the first year of policy Evaluating Policy Riders for Enhanced Coverage Extra protection features such as specific illness coverage, medical treatment spending support, and pregnancy care insurance enable policyholders to safeguard themselves better. Reading Customer Reviews and Insurer Reputation Research how well customers rate their insurance company plus their claim quickness and reliability. This will help you to improve your services and retain the existing customers for longer period of time. If customers will be happy and satisfied by your service then they will also recommend your company to their family and friends-Word of Mouth. Latest Trends in Family Health Insurance for 2025 AI-Driven Personalized Health Plans AI technology helps insurance companies design personal medical and health coverage based on family medical records and everyday activities. Digital-First Insurance Providers Policies and their associated management are now simple online through digital apps offered by insurance providers. Enhanced Mental Health Coverage More policies now cover mental health treatments, therapy sessions, and stress management programs. Focus on Preventive Care and Wellness Benefits Policies now encourage preventive health check-ups, free gym memberships, and wellness rewards

...Making sure your pets get medical attention involves buying a pet insurance policy as your financial backup plan. Getting veterinarian care and continuing medical care becomes easier when you choose a suitable insurance coverage for your pet. Thanks to our status as pet owners, we work to give the best experience possible to our animals. Good pet owners take care of their pets by making sure they eat healthily and seeing their vets while living in safe conditions. Medical emergencies force pet owners to pay large veterinary costs which strains their budget for caring for their beloved pets. A pet insurance policy steps in at this point to help. In this blog, we will share all the necessary information to select the best pet insurance policy for your pet which includes various policy types, payment elements, plan evaluations, and specialist tips. Understanding Pet Insurance What is pet insurance? When illness or injuries strike your pet there is a way to protect your finances: a Pet Insurance Policy helps you pay for help from the vet. Your pet insurance coverage helps you pay for a part of your pet’s medical costs so you can access top treatment at all times. Under this type of coverage you pay the vet now then submit reimbursement claims to the insurance provider. When you select firms that offer direct billing services they pay your vet directly so you need to spend less out of your own pocket. A Pet Insurance Policy pays for medical costs to ease the financial pressure of urgent medical procedures and continuous healthcare. Your pet’s health depends on picking the best insurance plan and giving you comfort at the same time. Choosing between various policy options becomes difficult even though many plans exist. How Does Pet Insurance Work? Pet insurance typically follows these steps: Choose a plan: Select a policy based on your pet’s age, breed, and medical history. Pay monthly premiums. The amount depends on coverage, deductibles, and other factors. Visit the vet. Take your pet for treatment when needed. Submit a claim. Pay the bill and send a claim to the insurer. Get reimbursed: The insurer processes the claim and reimburses a percentage based on your policy. Types of Pet Insurance Coverage Accident-Only Plans protects against injury types including fractures, wounds, and accidental poisonings. These plans protect against sickness, including infections, cancer and long-term medical illnesses. These Plans Take Care of Both Medical Emergencies and Regular Healthcare Services Wellness Plans Provide Basic Health Care, which Includes Regular Checkups Vaccinations and Dental Cleanings Your pet insurance selection depends on your pet’s health needs alongside their breed risks and available finances. Key Factors to Consider When Choosing a Pet Insurance Policy Key Factors to Consider When Choosing a Pet Insurance Policy Coverage Options The variety of pet insurance plans makes them different in their coverage range. Plans exist either for emergency care or for covering preventive medical needs. When evaluating policies, check for: Accident and Illness Coverage: Covers injuries, diseases, and hospital stays. Chronic Conditions: Includes long-term illnesses like diabetes and arthritis. Hereditary problems develop best in the following breeds. Wellness & Preventive Care: Routine checkups, vaccinations, and dental cleanings. Your insurance policy may include coverage for professional physical treatment sessions and related eastern therapies. Before your purchase, check details about what benefits and exclusions are part of the policy. These plans protect against sickness, including infections, cancer and long-term medical illnesses. These Plans Take Care of Both Medical Emergencies and Regular Healthcare Services Wellness Plans Provide Basic Health Care, which Includes Regular Checkups Vaccinations and Dental Cleanings Your pet insurance selection depends on your pet’s health needs alongside their breed risks and available finances. Cost and Premiums The amount you pay for a debit insurance policy depends on different elements including: The insurance rate increases according to a pet’s age and susceptibility to medical conditions while they belong to certain breed groups. Plans that cover complete health issues usually demand more money than basic accident protection. The prices of veterinary treatment in different areas determine insurance rates across regions. Choosing higher deductible amounts decreases your premium charges but raises how much money you pay yourself before insurance help arrives. To choose wisely assess different plans and decide which one gives you the best value for your money. You Need to Contrast Policies to Find Affordable Insurance Plans That Offer Good Protection. Look at different policies to identify affordable plans with quality protection. Do not select the least expensive plan until you verify its benefits. If you own multiple pets look for discounts that cover several pets at once. Deductibles, Reimbursements, and Payout Limits It is essential to know your personal costs versus what insurance will cover in detail. Your insurance starts paying only after you pay your annual or incident-based deductible. Can be annual or per-incident. Insurance companies pay a portion of the bill at the specified rates (70%, 80%, or 90%). The insurer establishes the highest yearly and per-condition payment amounts they will provide. Decide your reimbursement rate based on your finances, yet pick a level of insurance that offers good coverage. Example:If your pet’s surgery costs ₹50,000 and your plan has: ₹5,000 deductible 80% reimbursement rate ₹1,00,000 annual payout limit Your insurer will cover ₹36,000 (80% of ₹45,000 after deductible). Waiting Periods and Exclusions The cover needs to wait a defined span of time before taking effect in every insurance policy (14 days for sickness and 48 hours for injuries). Insurers also do not pay for: Pre-existing conditions Elective operations (e.g., tail docking, ear cropping) Breeding-related costs Tip: Insure your pet early to avoid pre-existing condition problems. Reputation and Customer Reviews Before choosing an insurer, consider: Claim settlement ratio: claim processing speed. Customer service: responsiveness and quality of support. Online reviews: real feedback from other pet owners. Tip: Choose a provider with good reviews and transparent claim processes How to Research Providers: Find customer reviews at reputable review websites. Read social media feedback. Ask other pet owners for business referrals. Comparing Pet Insurance Providers

...If you’re a business owner in India, chances are you’ve heard the saying, “Hope for the best, but prepare for the worst.” And while we all love to focus on the exciting parts of running a business, the truth is, protecting it with the right business insurance is non-negotiable. But here’s where things get a little tricky; understanding business insurance can feel overwhelming, especially with all the technical jargon flying around. Don’t worry! We’re here to break it down for you in simple terms. In this guide, we’ll take you through everything you need to know about business insurance in India. From the basics to the specifics, by the end of this blog, you’ll feel more confident about choosing the right insurance for your business. What Exactly Is Business Insurance? Let’s start with the basics. Business insurance is a type of coverage that protects your business from financial losses caused by unexpected events, like accidents, theft, legal claims, or natural disasters. Think of it as a safety net that helps you manage risks and ensures your business can bounce back after any unforeseen accidents or slip-ups. In India, there are different types of business insurance policies to cater to various needs, whether you run a small café or a large tech firm. Why Does Your Business Need Insurance? Here’s a reality check: Running a business comes with its own set of risks. No matter how well you plan, certain things can be beyond your control- fire, theft, natural calamities, or even lawsuits. Imagine your company’s equipment gets damaged in a flood, or a customer sues you for an accident that happened on your premises. Without the right insurance, these situations could lead to financial strain, even bankruptcy. With business insurance, you’re covered, and that peace of mind is priceless. Types of Business Insurance Available in India Now that you know why it’s important, let’s explore the different types of business insurance policies available in India. The key is to understand what fits your business needs. General Liability Insurance This is one of the most common policies and covers third-party claims against your business. Let’s say a customer slips and falls in your store, and you’re held liable for medical expenses. This policy would cover legal and medical costs arising from such accidents. Property Insurance This one’s crucial if you own or lease property for your business. It protects your building, office equipment, furniture, and inventory in case of events like fire, theft, or natural disasters. Whether you own a manufacturing plant or a small office space, this policy ensures that any physical loss or damage is taken care of. Workers’ Compensation Insurance In India, if you have employees, this insurance is vital. Workers’ compensation covers medical treatment, disability, or death benefits if an employee is injured or falls ill due to their job. It not only helps the employee but also protects your business from costly lawsuits. Professional Liability Insurance Also known as Errors & Omissions (E&O) insurance, this policy is essential for service-based businesses, such as consulting firms, law offices, or IT companies. It covers legal costs if your business is sued for negligence, errors, or incomplete work. So, if you’re in the professional services field, this one’s for you! Business Interruption Insurance What happens if a fire or a flood temporarily halts your business operations? Business interruption insurance ensures that your income is protected during such events. It compensates for lost revenue and helps you cover operating expenses while your business is getting back on its feet. Cyber Liability Insurance With businesses increasingly moving online, cyber threats have become a major concern. This policy covers losses caused by data breaches, cyberattacks, or other cyber-related incidents. If your business handles sensitive customer data or operates online, this insurance can protect you from the financial impact of cybercrimes. How to Choose the Right Business Insurance for Your Business? Now that you know the various types of policies, the next step is figuring out which one is right for your business. Here are a few things to consider: Evaluate Your Risks: Different businesses have different risks. A retail store might need more property coverage, while an IT firm may prioritize cyber liability. Think about the biggest risks your business faces, and choose insurance policies that cover those areas. Consider Your Budget: While it’s tempting to go all-in with coverage, you also need to stay within your budget. Look for a balance between comprehensive coverage and affordability. Sometimes, bundled packages can offer better value. Understand Policy Limits and Exclusions: Read the fine print! Every insurance policy has limits and exclusions i.e., things it won’t cover. Make sure you fully understand what is and isn’t included in your policy. Consult an Expert: Insurance can be complicated, so don’t hesitate to get professional advice. Insurance brokers or consultants can help you choose the best policy for your specific business needs. Common Business Insurance Myths—Busted! Let’s clear up a few misconceptions about business insurance: “Small businesses don’t need insurance.” No matter how small, every business is exposed to risks. From customer injuries to equipment damage, small businesses are often the most vulnerable when disasters strike. “Business insurance is too expensive.” The cost of not having insurance is far greater! One lawsuit or accident could cost you more than years’ worth of premiums. Conclusion Running a business in India is an exciting journey, but it’s important to protect it from unforeseen risks. Whether you’re a startup, MSME, or a large corporation, having the right insurance can make all the difference when it comes to surviving those unexpected bumps in the road. So, take some time to evaluate your needs, understand the available options, and invest in business insurance that ensures long-term security and peace of mind. After all, your business is your passion, and it deserves to be protected!

...Why the Manufacturing Sector Needs Specialized Business Insurance? If you own or manage a manufacturing business, you’re well aware that things can go wrong in ways you’d never expect. The manufacturing process involves complex machinery, a large workforce, valuable raw materials, and intricate supply chains. One small hiccup can send ripples across your operations and lead to significant financial loss. But what if you could shield your business from these risks? This is why specialized business insurance is not just a good idea, it’s a necessity. When you operate in a complex, fast-paced industry like manufacturing, the risks are diverse, and the stakes are high. Whether it’s safeguarding your expensive equipment, protecting your workers, or ensuring that a hiccup in your supply chain doesn’t result in massive losses, insurance tailored to your specific needs can be a lifesaver. In this blog, we’ll explore why manufacturing businesses need specialized insurance and how it acts as a vital safety net, allowing you to focus on growing your business without constantly looking over your shoulder for potential threats. Let’s break it down. Machinery Breakdown or Property Damage Picture this: your key machine breaks down unexpectedly. It’s not just the cost of repairing or replacing the equipment; it’s also the chain reaction on your entire production line including loss of retail sales. A halt in operations could delay deliveries, lose clients, and lead to loss of revenue. Your manufacturing facility, machinery, and raw materials are the backbone of your business. A fire, flood, or even theft could result in massive losses that are difficult to recover from. Commercial Property insurance can cover the repair costs and help minimize your downtime by compensating for lost income during the breakdown. Property Insurance for manufacturers goes beyond covering the physical structure. It also insures the contents of your facility, such as equipment, inventory, and materials. This means if the worst happens, you can bounce back quicker without worrying about how to finance repairs or replacements. Product Liability As a manufacturer, your responsibility doesn’t end when a product leaves your facility. If your product turns out to be faulty and causes harm to a consumer or damages property, you could face lawsuits. Without the right insurance, these claims can eat into your profits, or worse, bankrupt your business. Product liability insurance can step in to cover the legal expenses and compensation costs if someone sues over a defective product. This isn’t just about peace of mind; it’s about protecting your reputation and brand integrity. Worker Safety The manufacturing industry is physically demanding, and even with the best safety practices in place, accidents can happen. From slip-and-fall injuries to more serious incidents involving machinery, worker safety should be a priority. Worker’s compensation insurance is crucial for covering medical expenses and lost wages for employees injured on the job. It ensures that your workers are taken care of, while also protecting your business from costly lawsuits. Cyber Risks In today’s tech-driven world, manufacturers rely heavily on digital systems for everything from inventory management to client communications. But with this increased reliance comes the risk of cyberattacks. A data breach could expose sensitive business information, disrupt operations, and even result in legal claims. Cyber liability insurance is becoming increasingly essential for manufacturers. It can cover the costs of recovering from a cyberattack, including legal fees, notification expenses, and even PR efforts to restore your brand’s reputation. Why Specialized Insurance? You might be thinking, “Can’t I just get general business insurance?” The answer is- not if you want complete and comprehensive coverage for all your unique needs. General insurance might cover some risks, but manufacturing has unique exposures that require tailored solutions. Specialized business insurance for manufacturers where you can often hand-pick the add-ons you want for your specific business type is designed to address the specific risks that come with production processes, large machinery, complex logistics, and worker safety. It’s like having a custom-made safety net that fits your business perfectly, rather than a one-size-fits-all solution. Conclusion Running a manufacturing business comes with its share of risks, but the right insurance can help you manage those risks and focus on what matters most, i.e., growing your business. From protecting your equipment to guarding against product liability claims, specialized business insurance ensures that you’re covered when the unexpected happens. So, have you considered whether your current insurance plan truly covers everything your business needs? It might be time to explore specialized coverage and keep your manufacturing operations running smoothly, no matter what challenges come your way.

...Every business needs its physical assets for uninterrupted operations. While you can’t be 100% safe from situations like fire, theft or natural calamities, you can get commercial property insurance for the safe side. If you are not insured, recovering from such huge financial losses due to uncertain incidents can be next to impossible. You need it to protect the physical assets of your businesses and bounce back from an unexpected, devastating situation. A lot of businesses that faced fires, thefts or natural disasters had to shut down permanently because they did not have commercial property insurance. But those who had coverage managed to recover faster and continue working as usual. Let’s say a fire broke down in a small confectionery and it lost all its stock. But since it had coverage, it could replace everything and restart soon. What is Commercial Property Insurance? It’s a promising insurance policy that protects businesses from financial difficulties if their physical assets get damaged or lost. The assets that are typically included are: Buildings: If you own a workspace like a shop, office, warehouse etc, this insurance will cover any structural damage that happens to it so that expensive repairs don’t hold back your operations. Equipment: Whether you have computers or heavy machinery, it protects all tools of your trade which is a great relief for manufacturing businesses and service providers. Inventory: It covers the loss of raw materials, finished products and all the stock that was present in the premises. You can claim it in case there has been theft, fire or a disaster. Furniture & Fixtures: All essential furniture like workstations, tables, storage units, shelves etc are covered so that the workspace gets in the right condition once again. However, you must remember that everything is not covered. Here are the common exclusions: If the damage has been caused by war or terrorism, it requires separate policies. Age-related wearing and tearing is a maintenance issue that falls under business responsibilities. Those natural disasters that have not been specifically added to the policy will not be covered. Why is Commercial Property Insurance Essential? A single unfortunate event can ruin years of hard work and investment and leave you struggling to recover. In the worst case, businesses may even shut down permanently. The good news is that having property insurance for businesses works wonders because it: protects against unexpected events: A sudden fire, theft of assets, damage due to storms etc can happen anytime and leads to a big loss. But with an insurance policy, a business can get its inventory back and quickly recover. provides financial security: A disaster can ruin the property and the equipment. Insurance covers all the repair and replacement costs so the business can keep operating smoothly. meets legal and contractual requirements: Landlords often ask businesses to have insurance before they rent out their space. Banks offering a business loan may also ask for it to protect their investment. Benefits of Commercial Property Insurance A disaster can bring down the efforts of all the years to zero. Protecting your business is crucial. Commercial property insurance protects your business from uncertainties and helps you get back on your feet. Here are the benefits you get from an insurance for business property: Repair/ replacement costs are covered: The insurance covers everything from minor repairs to major replacements. All the expenses are taken care of so that businesses can recover without getting into financial burdens. Minimized downtime: Good coverage helps businesses recover quickly so they don’t face as much revenue loss. For example, a designer boutique whose stitching machines got burned could take up regular orders within a few weeks thanks to a quick insurance payout. Peace of mind: Entrepreneurs can focus on leveling up their business instead of worrying about the effects of unexpected disasters. They know that their business is protected and can operate with confidence. How to Choose the Right Commercial Property Insurance You can’t go for just any policy. It’s very important to find the commercial insurance coverage that matches your business requirements and provides you with the solutions you are looking for. Here’s what you must do to make the right decision: Assess your business needs: Risks differ for different locations, industries and asset values. You need to think of what can possibly hit your business. For example, if you are in a flood-prone area, you must have additional cover against the expected disaster. Compare policies and premiums: Not all insurance providers offer the same coverage options and prices. Do some research, check what’s included in different policies and then weigh all the options. Work with an insurance broker: It’s suggested to get in touch with a reliable professional. They will help you navigate different policies and find the most suitable one at the best price. That’s how you can get the essential protection without overpaying. Common Misconceptions About Commercial Property Insurance We discussed how a is so helpful when you need it. Still, a lot of people have their own myths about it and so they are not getting the coverage: Here are the most common false assumptions that people believe: My business is too small to need it– Disasters don’t look at the size of the business before hitting it. Even small businesses may experience theft, fires or any other unpleasant situation that will hurt them financially if they don’t have small business property insurance. General liability insurance is enough– Not at all. Liability insurance covers will never protect your physical assets, only injuries and lawsuits. If suppose there’s a burglary, your business will struggle without property insurance. It’s too expensive– If you look at the bigger picture, you will realize that the cost of insurance is not as much as the financial impact of an unexpected disaster. Find yourself an affordable policy that offers customized coverage. Asset protection without breaking the bank! Conclusion Don’t think of commercial property insurance as just another business expense because it’s something you won’t do without in case

...Top Risks Faced By Small Businesses And How Insurance Can Help Running a small business comes with its unique set of challenges. From managing daily operations to growing your customer base and expanding your market share, there are plenty of things that can keep business owners on their toes. Among these are various risks, some predictable, others completely unexpected, that could severely impact the survival of your business. Fortunately, the right insurance policies can offer protection, giving you the peace of mind to focus on growth. In this blog, we’ll explore the top risks faced by small businesses and how insurance can help mitigate these risks, ensuring that your business not only survives but continues to grow even in tough times. Property Damage Small businesses often operate out of a physical location, whether it’s an office, a retail shop, or a warehouse. One of the most significant risks to your business property comes from damage caused by fire, natural disasters, theft, or vandalism. The financial strain of repairing or replacing damaged property can be devastating without insurance. Commercial property insurance covers the cost of repairing your building, replacing damaged equipment, and recovering lost inventory. It ensures your business can get back on its feet quickly after an unexpected event, minimizing downtime and loss of income. Liability Issues Accidents happen, and when they occur on your business premises or as a result of your product or service, you could be held legally liable. Whether it’s a customer slipping on a wet floor or a product causing harm, liability claims can lead to expensive lawsuits and settlements that could cripple a small business. General liability insurance covers legal costs, settlements, and medical expenses related to third-party injuries or property damage. It’s a vital safeguard that prevents lawsuits from draining your financial resources and allows you to operate with peace of mind. Cybersecurity Threats With the increasing reliance on digital tools and online platforms, small businesses are becoming prime targets for cyberattacks. A data breach can expose sensitive customer information, result in financial loss, and damage your reputation, especially if you don’t have the resources to respond effectively. Cyber liability insurance helps cover the costs associated with a data breach, including notification expenses, legal fees, and the cost of recovering compromised data. It may also include public relations efforts to help restore your brand’s reputation after an attack. Employee Injuries Even in businesses with minimal physical labour, workplace injuries can still happen. Whether it’s an office employee tripping over loose cables or a warehouse worker getting injured by machinery, an on-the-job injury could lead to medical bills and lost wages, not to mention potential legal claims. Workers’ compensation insurance is designed to cover medical expenses and lost wages for employees who are injured on the job. It not only helps employees recover, but it also protects your business from costly lawsuits, ensuring compliance with legal requirements. Business Interruptions What would happen to your business if a natural disaster, fire, or other unexpected event forced you to shut down temporarily? For many small businesses, the loss of income during downtime can be financially draining. Rent, employee wages, and utility bills still need to be paid even when your operations come to a halt. Business interruption insurance covers lost income and ongoing expenses during periods when your business is unable to operate due to a covered event. It helps maintain financial stability while you work on getting your operations back to normal. Product Liability If your business manufactures, distributes, or sells products, there’s always the risk that one of those products could cause harm or injury to consumers. Product defects can lead to costly recalls, legal claims, and damage to your brand’s reputation. Product liability insurance covers legal fees and damages related to claims of injury or harm caused by your products. Whether the issue stems from manufacturing defects, design flaws, or inadequate warnings, this insurance ensures you won’t bear the full financial burden. Errors or Omissions In the service industry, disputes with clients over the quality of work or failure to meet expectations can result in legal action. Small businesses, especially those offering professional services such as consulting or design, are often at risk of being sued for errors or omissions in their work. Professional liability insurance (also known as errors and omissions insurance) covers the cost of defending against negligence claims and compensating clients for losses resulting from your services. It’s essential for businesses offering advice, consulting, or technical expertise. Conclusion Running a small business comes with risks, but those risks don’t have to keep you up at night. With the right insurance policies in place, you can protect your business from financial hardship and focus on what matters most: growth and success. From property damage to liability claims and cyber threats, insurance offers a crucial safety net that ensures your business is resilient and prepared for the unexpected. Have you reviewed your business’s insurance coverage recently? It might be time to explore the options available and ensure your small business is adequately protected from these common risks.

...Whether you are a seasoned professional or a top business owner, no matter how smart you are, it’s very human to make mistakes. There is always some risk with consulting and providing services but if it causes a financial or legal problem to your clients, what will you do? Dealing with a lawsuit or claim is never easy. It can put you under severe financial strain, there can be a loss of credibility and might even end up shutting your business. Professional Indemnity Insurance (PII) will protect you when things go out of control. What Is Professional Indemnity Insurance? Let’s start with the basics of the concept. In simple words, even if you make a mistake, your business can continue to operate and you won’t have to face any financial troubles. If your client claims to suffer a financial loss or any other damage because of you, PII will support you throughout the situation. It could be an honest mistake but since it has impacted the client, you will have to pay for that. Thankfully, this insurance will cover the legal fees and other settlement costs that will be needed. Why Do You Need It? It takes only a small mistake to get slapped with lawsuits, lose a lot of money and ruin the entire reputation that you built over the years. If you are a service provider, you must have a PII. Here’s why: Mistakes Happen: It’s human to make mistakes. Even an accidental oversight in a report or calculation can lead to claims. This insurance won’t let your business be at risk because of a single error. Part of The Contracts: Some clients specifically ask you to have a PII to work with them and it also reflects your professionalism. Your potential clients can see that you take all responsibility for the work very seriously and are well-prepared for any situation. Reputation Protection: Legal actions can blemish a business’s image. If you have PII, your issues will be resolved quickly with the least damage. You will come across as more credible and committed to high standards of service. Hence, the clients will trust you more. Financial Security: It’s neither easy nor affordable to fight legal battles. Even minor claims can cost you a lot. But PII ensures you are not financially hit. With this insurance, you won’t have to pay the fee or compensation out of pocket. What Does It Cover? Professional Indemnity Insurance typically covers a bunch of situations that can cause you serious troubles: Negligence: It will save you if you fail to meet the expected level of care at work. Example, an accountant miscalculates tax liabilities leading to financial penalties for the client. Breach of Duty: If there has been a compromise with the confidentiality of the client or intellectual property like a consultant accidentally leaking sensitive client data. Such lawsuits will be managed. Defamation: Let’s say you caused unintentional harm to someone’s reputation like publishing incorrect information about a client, you could face legal action but PII will handle it. Errors or Omissions: If your mistakes made the client suffer financial losses, it will be settled through the insurance. Example, your marketing agency gave incorrect product details and now the client is losing sales. Legal Costs: Even if the claim is baseless or you are not guilty, you still have to defend yourself in court and this is an expense. PII will cover lawyer fees and court expenses that have been incurred in the process. Settlements: In case you are found guilty, you would have to settle with compensation to the clients. It can range from a few thousand to millions but thankfully, it’s insured. However, you must remember that PII only covers honest mistakes and unwillful actions. If, upon searching, any evidence of fraud or intentional misconduct, is found, there will be no PII help. Who Needs Professional Indemnity Insurance? If it’s in the nature of your work to impact clients financially or handle sensitive information, considering PII is a must. With this, you can confidently provide services without the fear of facing legal repercussions. It’s extremely important for: Consultants and Advisors: One wrong piece of advice and your clients could face financial consequences. Suppose a financial consultant recommends an investment that leads to losses for the client. Medical Professionals: You can always expect legal action against you if patients feel mistreated. Poor diagnosis or prescription errors would wreak havoc on you. Legal Professionals: Inaccuracy in documents or errors in representation can be a costly situation. If a lawyer misses the deadline or a hearing, the client will face losses. Architects and Engineers: Of course, any mistake in design or calculations will be a disaster. A miscalculation will ruin the structure and will cause property damages and lawsuits. How to Choose the Right PII Policy? Picking the right policy is very important and it’s also easy if you consider these points: Know Your Risks: Each industry has unique risks associated. Make sure all the risks of your profession are covered. Coverage Limits: Be sure that your policy can handle even worst-case scenarios and you can get the maximum claim amount. Industry Needs: Besides the basics, the policy must also provide additional protection against specific industry-related situations. Ease of Claims: Always select an insurer that processes claims without any hassles. They must have a good reputation for quick service. Check reviews and testimonials before finalizing. Balance Cost and Coverage: Cheaper policies often offer limited coverage. Be safe and compare premiums to the potential financial impact of a certain legal action. When Should You Get PII? Honestly, immediately! It’s normally suggested to have a policy in hand even before you start offering services or signing contracts. If you wait too long, you are at a higher risk of being exposed to unnecessary troubles. A lot of PII policies only cover claims filed while the policy is active. In case you cancel your coverage and then make a claim, it won’t be covered, even if

...